New Stock Trend Detector: A Review of the 1929-1932 Panic and the 1932-1935 Bull Market With New Rules for Detecting Trend of Stocks

31.77 $

🎯Core Concepts:

- Geometry & Charting

- Time & Cycle Studies

- Proportions & Levels

The New Stock Trend Detector is one of W.D. Gann’s most practical works, written in the aftermath of the 1929 crash and the subsequent bull market. In this influential book, Gann provides a detailed review of one of the most dramatic financial periods in history, explaining how his unique methods of trend analysis, price–time relationships, and cyclical forecasting allowed him to anticipate major market moves.

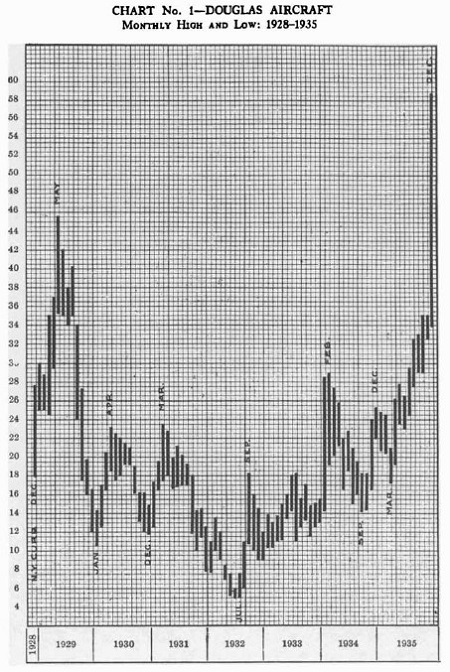

Gann breaks down the 1929–1932 panic and the 1932–1935 recovery, showing step by step how his trading rules could have guided traders safely through both collapse and resurgence. He emphasizes the importance of trend detection, swing charts, percentage retracements, and support/resistance levels, teaching readers how to identify market direction with accuracy and discipline.

What makes this book particularly valuable is its blend of real historical analysis with actionable trading techniques. Rather than abstract theory, Gann uses actual market data to illustrate his principles, making the material both educational and immediately practical.

For traders, analysts, and historians, The New Stock Trend Detector is an essential resource that demonstrates how Gann’s methods perform in real-world conditions. It is both a historical case study and a timeless guide to understanding market cycles and price behavior.

✅ What You’ll Learn:

- How W.D. Gann analyzed the 1929–1932 market crash and the 1932–1935 bull market.

- Methods for detecting and trading major stock market trends.

- Practical application of swing charts, retracements, and support/resistance.

- How to identify when a trend has reversed.

- The importance of time cycles and natural law in forecasting.

- Risk and money management rules from Gann’s teachings.

- How to apply Gann’s historical lessons to modern markets.

By studying this book, traders gain insight into how Gann’s methods stood the test of one of the most turbulent market periods in history—and how those same principles can guide trading today.

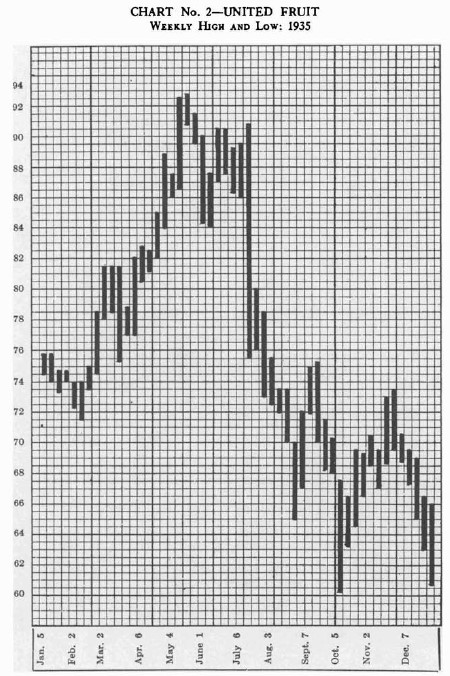

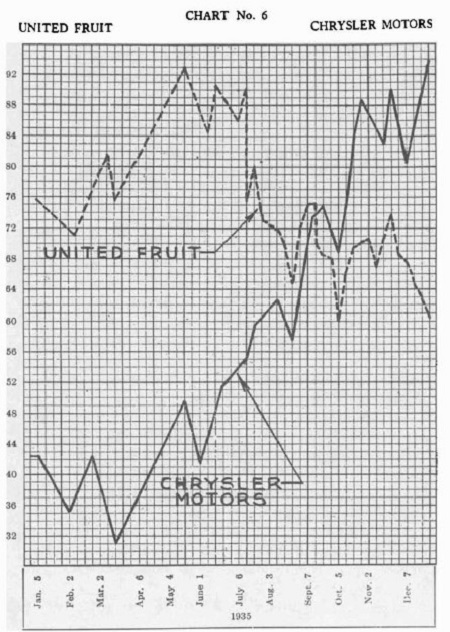

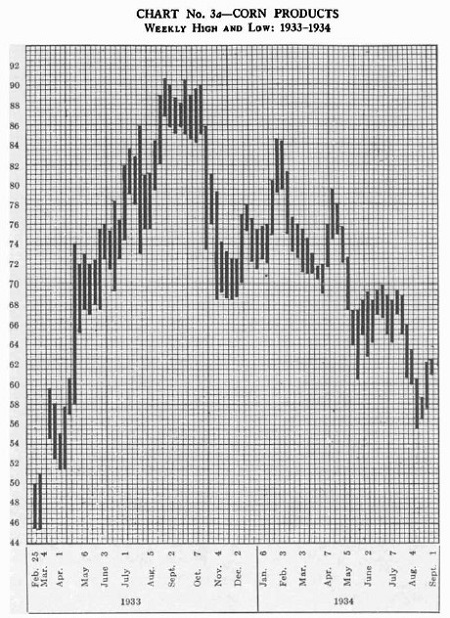

Some Pictures From the Book

Gann’s Note:

A man writes the best and does the most good for others when his object in writing is not to make money or gratify ambition or gain publicity, but to help others who need help and appreciate his efforts.

When I wrote TRUTH OF THE STOCK TAPE in 1923, it was because there was a demand for a book of that kind. People needed the help that I could give them and the benefit of my experience and knowledge. In that book I gave the best I had and received my reward. People appreciated my efforts. They bought the book then and they are still buying it. They say it is a good book and more than worth the money. That is very gratifying to me.

After the 1929 bull market culminated there was a demand for a new book to meet changed conditions under the so-called “New Era,” so I wrote WALL STREET STOCK SELECTOR in the Spring of 1930. I gave freely of my knowledge and the benefit of years of experience. This book helped others to protect their principal and make profits. People who read the book pronounced it one of the best. It is still selling, and again I have been rewarded.

No man can learn all there is to know about forecasting the trend of stocks in 3, 5, 10, or 20 years, but if he is a deep student and hard worker, he learns more and knowledge comes easier after years of experience. I knew more about determining the trend of stocks in 1923 than I did in 1911. Seven more years of experience gave me more knowledge and enabled me to write the WALL STREET STOCK SELECTOR in 1930 and give my readers the benefit of my increased knowledge. Now, after five more years have elapsed, my experience and practical test of new rules have enabled me to learn more of value since 1930.

The 1929-1932 panic and what has followed since, gave me valuable experience and I have gained more knowledge about detecting the right stocks to buy and sell. I cannot lose if I pass this knowledge on to those who will appreciate it. Hundreds of people who have read my books have asked me to write a new book. Again, I answer the call and meet the popular demand with NEW STOCK TREND DE· TECTOR. I believe the book will help others to avoid some of the pitfalls of reckless speculation. If I can lead a few more to the field of knowledge, I shall again be amply repaid for my efforts.

W. D. GANN (January 3. 1936, 88 Wan Street, New York.)

Table of Contents:

- New Deal in Wall Street

- Foundation for Successful Trading

- History Repeats

- Individual Stocks vs. Averages

- New Rules to Detect Trend of Stocks

- Volume of Sales

- A Practical Trading Method

- Future Trend of Stocks.

New Stock Trend Detector: A Review of the 1929-1932 Panic and the 1932-1935 Bull Market With New Rules for Detecting Trend of Stocks By William Delbert Gann

| Author |

William D. Gann |

|---|---|

| Pages |

102 |

| File Types |

|