Articles

Trading with the Time Factor (Vol 1 and 2)

Trading with the Time Factor course will change the way you look at financial markets. By the end of it, you will have learnt the geometric secret that is present in all markets – and that you too can achieve what others will tell you is the impossible. The Time Factor is a phenomenon which exists in all financial markets. Once understood, it is a powerful tool that can allow you to calculate predictable and repeating market cycles so that you can better time your investment decisions.

Author’s Note:

It is possible to do what many will tell you is the impossible. I am convinced there is a calculable geometric symmetry present in all financial markets. The secret is knowing how to find it. Once you know how to find it, you can apply it to predict the exact time and date of future market tops and bottoms, sometimes years in advance.

I am certain of this geometry because I have I seen it. I have also been able to predict it occurring in the markets time and time again. In 2001, I am on the record for outlining in writing that my timing calculations were indicating that ‘September 11, 2001 is a date to be wary of.’ I also nominated the date which proved to be the yearly low for the Australian stock market in 2001 to the exact day. All of this before the event.

I saw the geometry that unfolded in the precious metals Gold market which coincided with the end of the 20 plus year bear campaign in gold prices. It enabled me to make a number of long term investment decisions, including a first purchase of gold bullion when it was trading just above US$300 an ounce. Interestingly, the same geometry which ended the 20 year bear market was also present to within a week of calling the current all-time top in gold prices. In this course, I will share with you how all that unfolded.

I have calculated, and have shared with colleagues (including my stock broker), future dates to watch in the Australian stock market which have been accurate at predicting major turning points in the market, more than two years in advance. More recently in 2011, I wrote to friends and colleagues outlining that the US equities markets will continue on to higher prices in 2012 and 2013 – advancing the bull market in US equities that has since reached all-time record prices.

My friends and colleagues often ask me to explain how I can do it. However I have always felt that it would need a book to provide them with an adequate answer. So, after much convincing, I guess this is that book. This book draws upon the input and experience of my good friend and long term confidante, Frank “Bob” Nigro.

Together, we will be sharing with you over 30 years of collective experience in the financial markets and thousands upon thousands of hours of study and research into the trading techniques which we have seen consistently working for us to predict future market tops and bottoms. We have seen which techniques work. We have also figured out which ones don’t.

The course summarises that 30 years of experience into simple to follow descriptions and illustrations. It does much of the hard work for you so that you can better understand the financial markets. It filters out the best of the best – and allows you to apply these techniques to your own stock, commodity or currency market analysis. Importantly, I will show you how to apply these Trading Tools in a manner that is simple to calculate and easy to understand. A few of these techniques are what Bob and I consider to be the best of those used by many of the professional traders and hedge fund managers currently out there. The majority however have been adapted off the works of W.D. Gann – who was legendary for his contribution to trading by technical analysis.

The Trading Tools I am about to share with you have proven the test of time. They worked over one hundred years ago and I am confident they will continue working for the next one hundred years. This course will change the way you look at financial markets. By the end of it, I am confident that you will have learnt the geometric secret that is present in all markets – and that you too can achieve what others will tell you is the impossible.

| Author | Frank Barillaro |

| Pages | 193 |

| Published Date | 2012 |

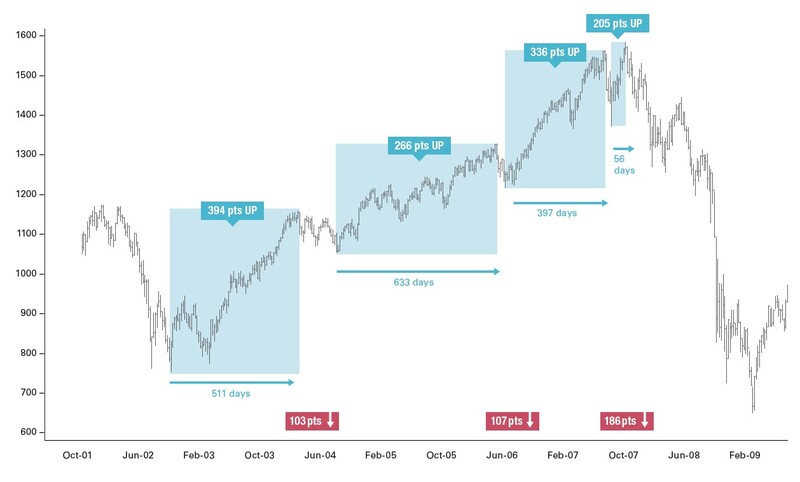

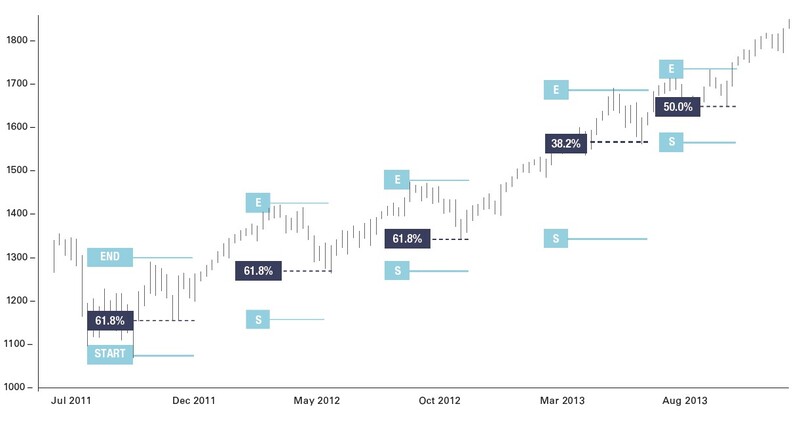

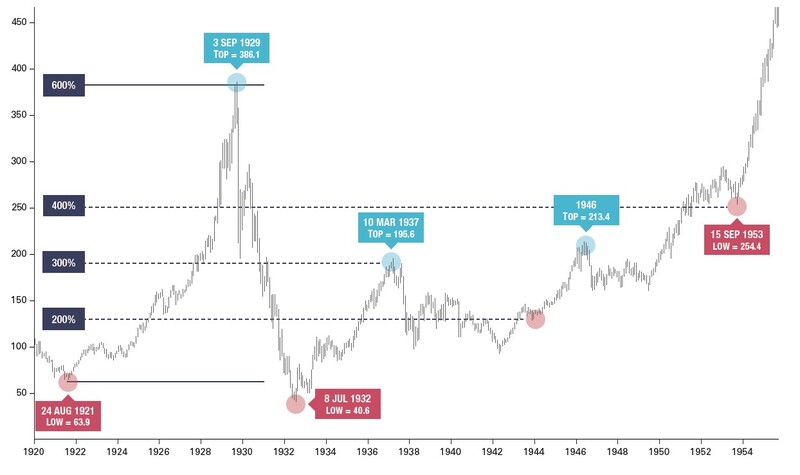

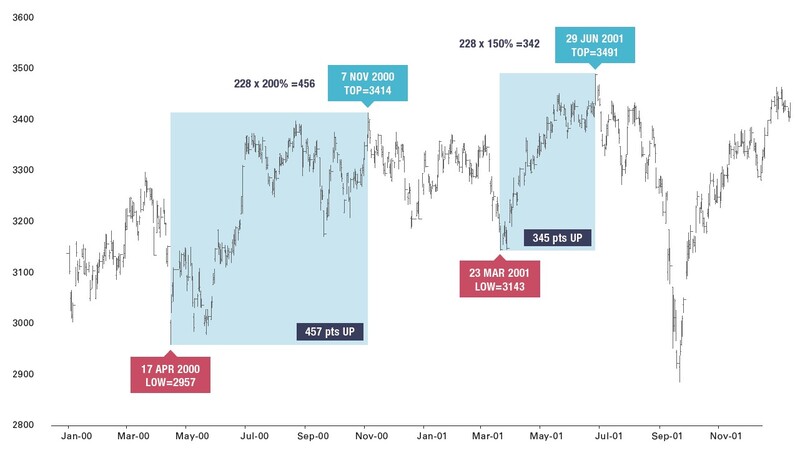

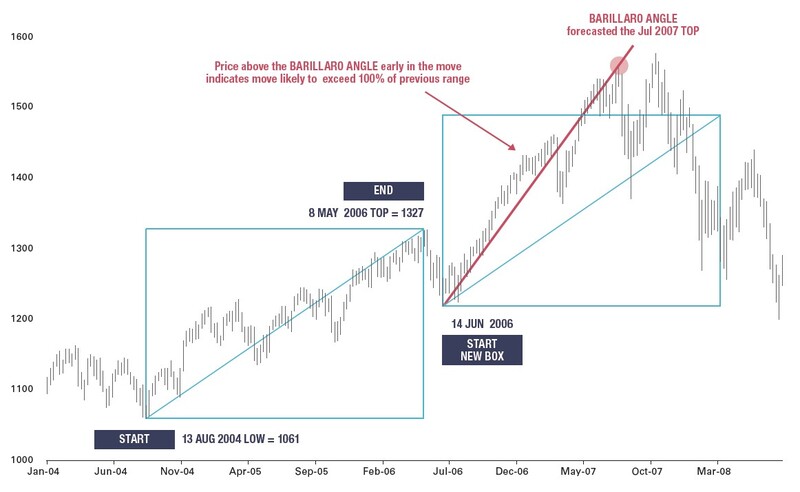

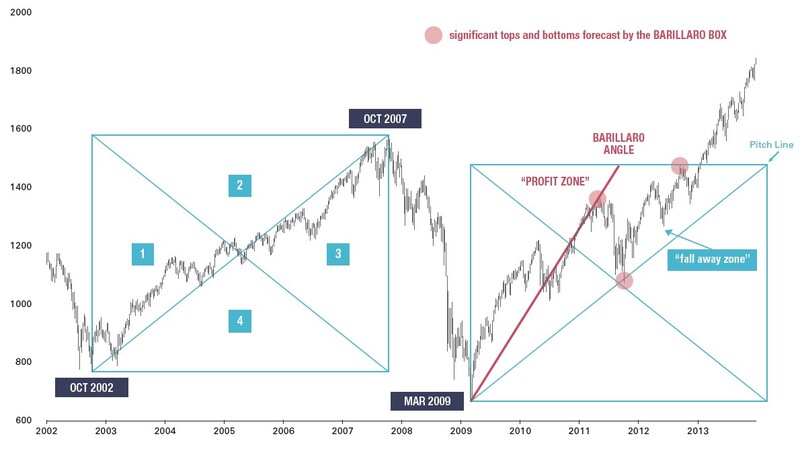

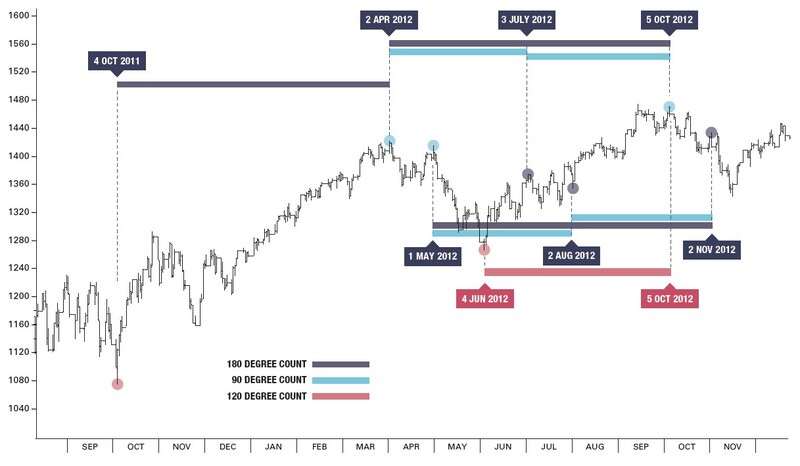

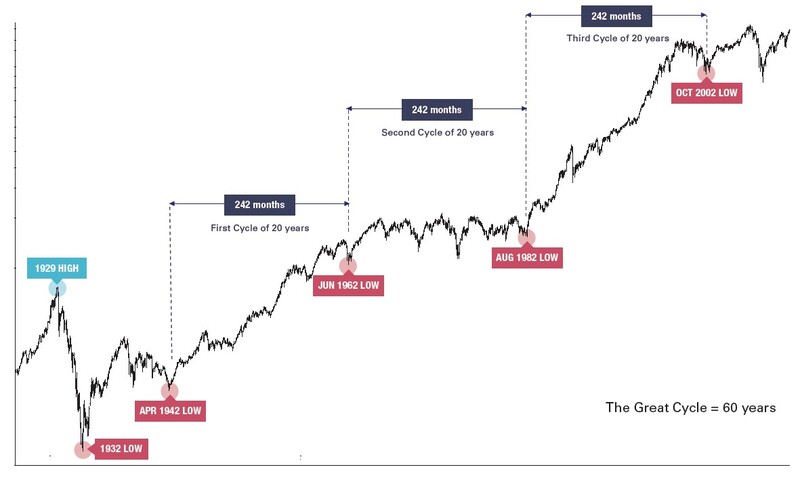

Some Pictures From the Book

Table of Contents:

- How to know you are trading with the trend

- Sections of the market

- The trend measuring techniques used by the professionals

- Price retracements

- How to use previous tops and bottoms to forecast future prices

- Price projections

- How to determine the strength of a move

- Time and price angles

- Trading psychology and risk management

- The best trading entry and exit points

- Repeating time

- Anniversary dates

- Trading to Time

- Counting time

- The Master Time Factor – explained, simply

- How to know when you are right

Trading with the Time Factor (Vol 1 and 2) By Frank Barillaro