Articles

Trading A Small Account By Myles Wilson Walker

Many people who are trading are only doing so part time while they begin in a small way and build their expertise and capital. The problem of course is that when you have limited capital you need to be very sure of your trade selection method and it has to give you a definite edge.

A company that has a large capital base can take a casino approach to the markets and use trading systems that are fairly average so long as they are nett profitable and give them the advantage over hundreds of trades. The small trader must succeed virtually right away ruling out most trading systems as they usually entail large drawdowns.

Many Gann traders are using Ganns geometric angles on daily charts. These work reasonably well over time but by them selves they do not give the beginning trader the necessary advantage.

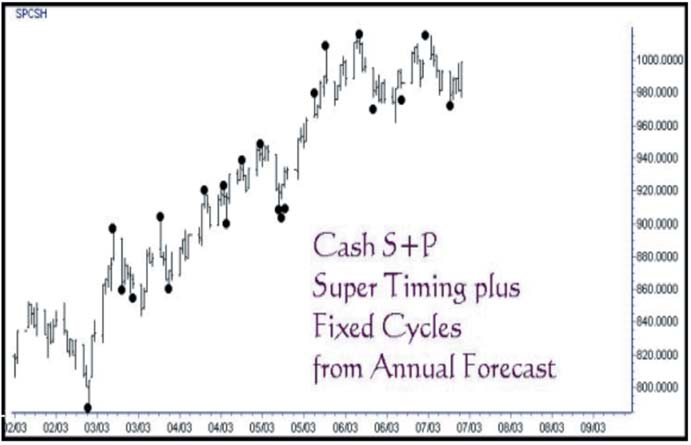

The market is comprised of only two elements, Time and Price. If you can get a large enough edge from one of these elements you can succeed. Below is a chart of the cash S+P on this I have marked every Super Timing date and fixed planetary cycle for the S+P from my Annual Forecast for 2003.

This was emailed out in December 2002 to everyone who has ever bought a copy of Super Timing and whom I had a current email address for. This is proof that my methods work.

I know that people often do not really take the time necessary to learn new things or to understand them but want to get trading right away and that is also a reason why I send out the forecast every year. I always tell people what the forecast dates are comprised of so they can do it them selves but you can improve the forecast dates by learning the dynamic methods I teach as this will tell you where the biggest pressure points will be.

Starting at the major low on March 12th to July 21st I have marked every Super Timing date and Fixed cycle for the S+P from my Annual Forecast for 2003 mailed out in December 2002. The point I am making is that this is not hindsight trading and is 100% mechanical. Also this is not the best example I could have chosen but it is recent and in the public record. Notice it catches the main highs and lows plus the majority of minor swings.

The over all trend after the Super Timing low of March 12th was up but even then the 100% mechanical planetary method caught the majority of counter trend swings as well. This is the kind of edge that allows you to set small stops. Another low risk method for a tiny account would be the use of options. OEX (S+P 100) Option Plan for Trading Intermediate Swing Points. This option strategy is excellent because positions are taken at the beginning of intermediate sized swings where the risk reward is very favorable.

An intermediate swing is classed as 40 points on the OEX and is approximately 80 points on the S+P. The plan is simple.

Determine the timing of the trend change using the Super Timing Method. Buy a Put or Call with 4 to 6 weeks of time remaining.

Select a strike that’s about 40 points away from the current high or low Pay 4 to 5 points for the option.

🔍 Master Gann’s Tools – Recommended Ebooks

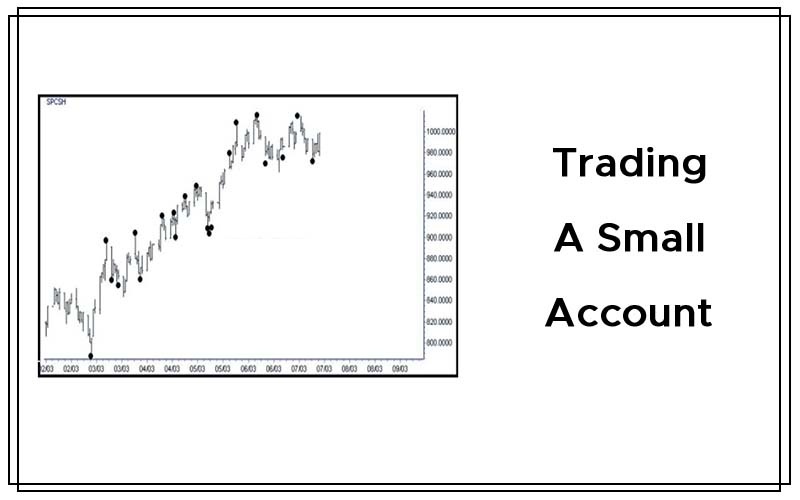

Exit the option when it becomes “at the money” i.e. the OEX has declined 40 points from its last swing high or appreciated 40 points from its last swing low. The chart in this article shows what happened in two cases.

- a to b is the October 10th low 2002 so calls were purchased.

- c to d was the high January 13th 2003 so puts were purchased.

In both case marked there was an immediate profit of $1500 per option as the option reached its strike price. The low on March 12th also produced good profits using this plan and if you take a good look at the chart you will find many other instances where this plan was profitable.

Also it fits the criteria of being small risk if you are wrong but has a large reward when you are correct. A good risk reward ratio will allow you to comfortably build your account.

Also it fits the criteria of being small risk if you are wrong but has a large reward when you are correct. A good risk reward ratio will allow you to comfortably build your account.

Super Timing is the only book, which contains the correct Gann timing methods. The Book is very detailed at over 400 pages including the material on the CD and covers three main areas, W.D.Ganns Astrology and Price Target Method. Plus fixed planetary Cycles (how to work them out for any market) And Dynamic Astro Cycles.

Mr. Wilson is author of the book Super Timing and Intro to Astro.