Truth of the Stock Tape: A Study of the Stock and Commodity Markets With Charts and Rules for Successful Trading and Investing

15.47 $

🎯Core Concepts:

- Geometry & Charting

- Time & Cycle Studies

- Proportions & Levels

Truth of the Stock Tape (1923) by W.D. Gann is a classic cornerstone in trading literature and one of the earliest comprehensive works on technical market analysis. In this book, Gann lays out his philosophy that the tape never lies, emphasizing that price action itself reflects all the hopes, fears, and knowledge of market participants.

Gann explains how to interpret the stock tape—today understood as price charts—to identify accumulation, distribution, support, and resistance levels. He shows how to read market movements as a continuous story of supply and demand, and how repeating patterns reveal the psychology of traders across cycles. The book also details Gann’s practical trading rules, including stop-loss principles, capital management, and the importance of discipline.

Unlike his later esoteric works, Truth of the Stock Tape is direct and practical, making it an excellent entry point for traders new to Gann’s methods. Yet, it also contains the seeds of his broader theories on time cycles and natural law, demonstrating how markets unfold according to recurring rhythms.

For both beginners and experienced traders, this text remains an essential resource for mastering the art of reading price action and building a disciplined trading approach.

✅ What You’ll Learn:

- How to read the tape and interpret price movements with precision.

- Gann’s methods for identifying accumulation, distribution, and trend shifts.

- The importance of support, resistance, and volume analysis.

- Practical trading rules, including stop-loss strategies and money management.

- How repeating market patterns reflect human psychology.

- Insights into Gann’s early thinking on time and cycle principles.

- A practical foundation for applying Gann’s broader theories to modern markets.

By studying this book, traders gain the skills to read markets directly from price action, developing the discipline and insight needed for long-term success.

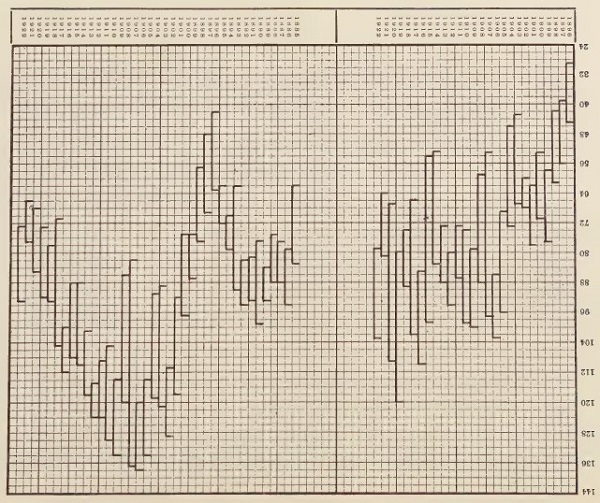

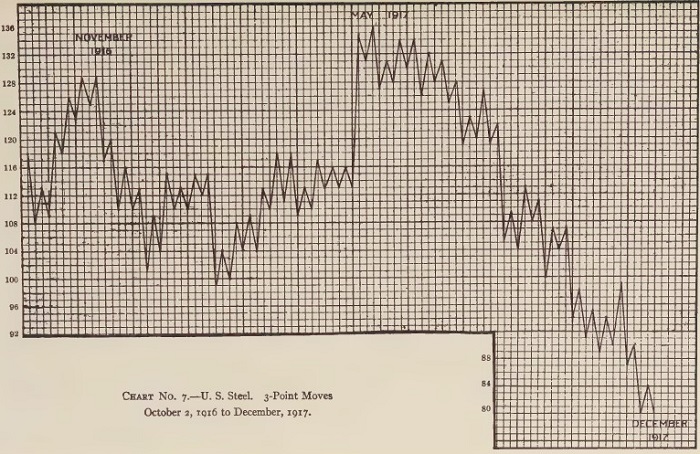

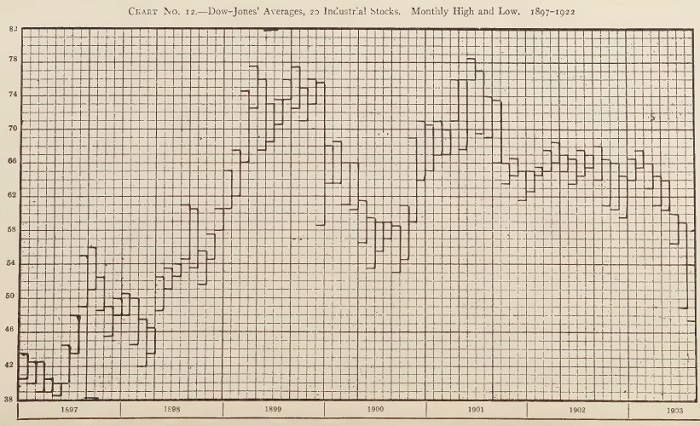

Some Pictures From the Book

Gann’s Note:

“Receive my instruction, and not silver; and knowledge rather than choice gold. For wisdom is better than rubies, and all the things that may be desired are not to be compared to it.”– PROV. 8: 10-11.

In addressing you on the subject of investing your surplus funds, I might state that there is no other subject which I could select that so closely concerns your welfare and regarding which you might receive valuable assistance from my instructions. In the United States a stupendous sum, reaching into millions of dollars, is wasted annually in foolish speculations and unwise investments. This senseless waste can be traced to one and only one source, namely, lack of knowledge. Men and women who would not attempt to treat the slightest ailment, or even adjust so common a thing as a kitchen faucet, but would hand each difficulty over to its respective specialist, the doctor or the plumber, will on the spur of the moment and without the slightest preparation, undertake the investment of thousands of dollars in enterprises about which they understand absolutely nothing. Is it any wonder then that they lose?

I offer you suggestions and advice in the science of speculation and investment in the same spirit as the physician. He would not think of guaranteeing you perpetual life or insuring you against the common ills to which the flesh is heir. But in your difficulties he brings to your aid the accumulated experience of his profession, and a skill and knowledge which required years to accumulate and is ready for your instant use. I do not offer you a beautiful theory which will not work in practice, but give you invaluable advice, which if followed, will insure success in practical everyday Wall Street speculations and other fields of investment.

It has been well said that a writer who writes first for remuneration and secondly because he believes what he writes, will never achieve enduring fame, and that the salesman who does not believe in his goods will never make a success. I believe in the theory and rules that I have laid down in this book for you to follow, because I have tested and proved them.

It is my object in this work to facilitate and focalize the essential principles for practical use. My knowledge comes from over twenty years’ experience, in which I have traversed the rough and rugged road that the inexperienced trader’s foot must press before he reaches the goal. Hence my object in writing this book is to give to the public something new and practical, not theory alone which would fail in practice.

Read this book carefully several times; study each chart and subject thoroughly, and a new light and knowledge will come to you every time you read it. If I succeed in teaching only a few to leave wild gambling alone and follow the path of conservative speculation and investment, my work will not have been in vain and I will have been amply repaid for my efforts.

W.D. GANN. (NEW YORK CITY, January 27, 1923).

Table of Contents:

BOOK I :PREPARATION FOR TRADING

- WHAT IS TAPE READING?

- CAN MONEY BE MADE IN WALL STREET? OR CAN THE STOCK MARKET BE BEATEN?

- HOW TO READ THE STOCK TAPE

- HOW THE TAPE FOOLS YOU

- HOW STOCKS ARE SOLD

- YOUR WEAK POINTS

- ESSENTIAL QUALIFICATIONS

BOOK II : HOW TO TRADE

- RULES FOR SUCCESSFUL TRADING

- METHODS OF OPERATING

- CHARTS AND THEIR USE

- THE SEVEN ZONES OF ACTIVITY

- HABITS OF STOCKS

- DIFFERENT CLASSES OF STOCKS

- HOW TO READ THE TAPE CORRECTLY

- WHEN THE TAPE INISHES AND GIVES FINAL SIGNALS

BOOK III: HOW TO DETERMINE THE POSITION OF STOCKS

- POSITION OF GROUPS OF STOCKS

- GENERAL TREND OF THE MARKET

- HOW TO TELL THE STOCKS IN STRONGEST POSITION

- HOW TO TELL WHEN STOCKS ARE IN WEAK POSITION

- JUDGING FINAL TOPS AND BOTTOMS

- NUMBER OF TIMES A STOCK FLUCTUATES OVER THE SAME RANGE

- CROSSING OLD LEVELS

- TOPS AND BOTTOMS ON RAILROAD STOCKS

- BOTTOMS AND TOPS ON INDUSTRIAL STOCKS

- ACCUMULATION OF LOW-PRICED STOCKS

- HOW TO WATCH INVESTMENTS

BOOK IV: COMMODITIES

- HOW TO TRADE IN COTTON

- PROPER WAY TO READ THE COTTON TAPE

- HOW TO DETERMINE A CHANGE IN TREND

- THE BOLL WEEVIL

- WHEAT AND CORN TRADING

- JUDGING ACCUMULATION AND DISTRIBUTION ZONES

Truth of the Stock Tape: A Study of the Stock and Commodity Markets With Charts and Rules for Successful Trading and Investing By William Delbert Gann

| Author |

William D. Gann |

|---|---|

| Pages |

201 |

| File Types |

|