Articles

Practical Application of an Authentic ‘Square of Nine’ – Part One

The ‘Square of Nine’ or ‘Pythagorean Cube’ or ‘Odd Squares Calculator’ has been talked about as one of W. D. Gann’s most important trading tools. There is no doubt that he used it extensively. One of the most important discoveries made by Lambert-Gann Educators, Inc. in the Lambert-Gann Publishing Co. archives is a ‘Square of Nine’ with a date ring on top revolving around a center pin. This revolving ring allowed the date to be moved over the top of the price of a major top or bottom.

Lambert-Gann Educators, Inc. created the ‘Natural Squares Calculator’ to bring to the public a trading tool that teaches the principles that Mr. Gann used in trading with the ‘Square of Nine’. Without a movable date ring, a ‘Square of Nine’ calculator cannot be synchronized with the current market vibration. This is like drawing a Gann angle, but not starting it from a high or low. This visual synchronization clearly demonstrates how accurate this tool can be. It also shows that learning the basics of using a ‘Square of Nine’ in this manner is not difficult.

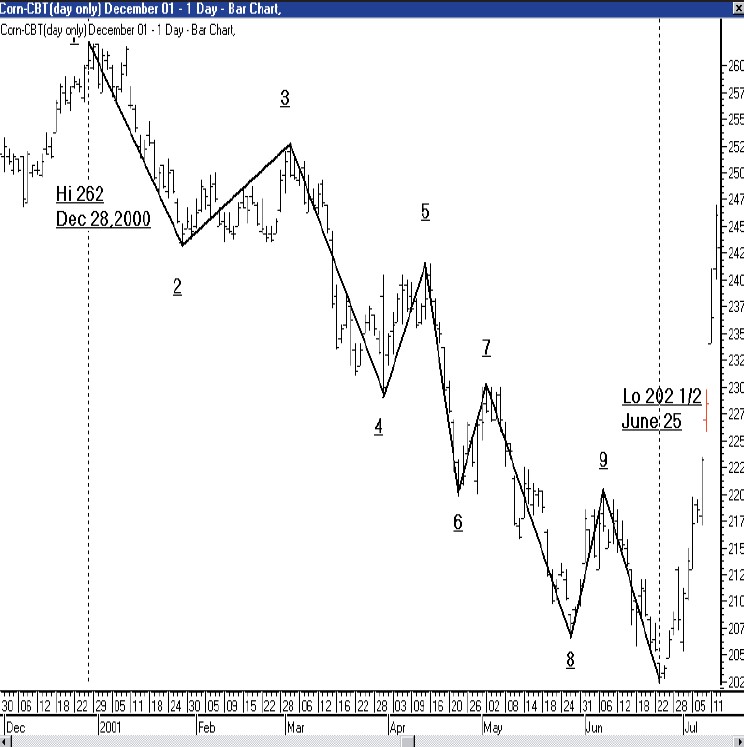

Part One of this article will deal with the price aspect of a synchronized ‘Calculator’. Part Two of the article will use the ‘shifted time’ to show how the synchronized ‘Calculator’ repeatedly forecasts changes in trend as harmonized time and price align. The following chart is of continuous December Corn. According to Mr. Gann’s writings, we should link together December Corn contracts forming one continuous contract of corn containing only the December contract. The major high shown in this chart is at the price of $2.62 on the date of December 28, 2000.

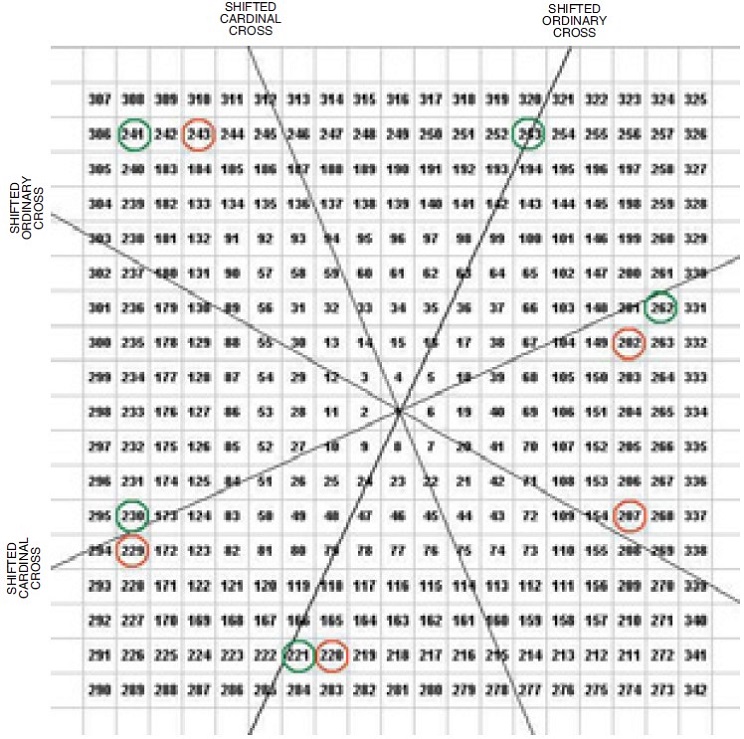

Mr. Gann repeatedly described the Cardinal Cross (90-, 180-, 270- and 360-degree angles) as the most important points of support and resistance. The second most important was the Ordinal Cross (45-, 135-, 225-, and 315-degree angles). By timing the calculator to the major high price of 262, we have shifted the Cardinal Cross and Ordinal Cross prices so they are in harmony with the market vibration. To do this on a ‘Natural Squares Calculator’, we simply move the center ring (Square of the Circle) so that the Zero Degrees line is over the price of 262.

📘 Ebooks on Gann’s Methods & Techniques

We have now created a new Cardinal Cross and Ordinal Cross (see Square of Nine picture). The Cardinal numbers have shifted from 249 to 245 ½, from 233 to 229 ½, from 218 to 215 and from 204 to 201 ½. The Ordinal Cross numbers have shifted from 257 to 253, from 241 to 237, from 225 to 221 and from 211 to 207. From now on, any reference to the Cardinal and Ordinal Cross numbers will be to the ‘shifted’ numbers.

In addition, I have circled the referenced highs in green and lows in red as Mr. Gann did on his Calculators to make the visual application clearer. From the major high at 262 the market made the first move down to No. 2 (on the chart) at 243, holding within 2 ½ cents of the 90-degree Cardinal Cross support. It then made two more attempts at the same level, finally rallying from the 3rd bottom to the high marked No. 3. The price at No. 3 is 252 ¾, which is exactly one-half way back and also back to the 45-degree Ordinal Cross.

The next leg down goes to No. 4 at the price of 229, which is at the 180-degree Cardinal Cross. Mr. Gann said the strongest angle was the 180-degree angle, making this a place for a potential rally. The rally to No. 5 stopped at 241 ¼, which is at an unshifted Ordinal Cross providing resistance. The next move down to No. 6 stops at 220, which is one cent from the 225-degree Ordinal Cross. From there the rally back up to No. 7 is to the old bottom of 230, which again is the 180-degree Cardinal Cross.

Once more, the market starts down through the old bottom of 220 and the 270-degree Cardinal Cross to the 315-Cardinal Cross support price of 206 ½ at No. 8. The rally back up to No. 9 is back again to the old bottom of 221 and the 225-degree Ordinal Cross. The final move to the bottom at No. 10 goes to the price of 202 ½, which is within one cent of the 360-degree Cardinal Cross and next to the beginning at 262.

Of the five waves down, three were almost exactly 135 degrees on the calculator. They were from No. 3 to No. 4 (45 degrees to 180 degrees), No. 7 to No 8 (180 degrees to 315 degrees) and No. 9 to No. 10 (225 degrees to 360 degrees). The ‘shifted’ Cardinal and Ordinal Crosses provided the resistance or support for 8 of the 9 changes in trend during this down move. The 9th resistance point came from the ‘unshifted’ Ordinal Cross.

There is no doubt that a synchronized ‘Calculator’ will provide superior harmony for a market. In Part Two I will show how Mr. Gann would have known when the aligning of time and price is occurring simply by checking his ‘Calculator’ daily. Chart of December Corn from December 2000 through June 2001. Hand Drawn Square of Nine Synchronized with Dec Corn Market at 262.