Articles

Gann for the Active Trader: New Methods for Today’s Markets

INTRODUCTION

In writing this book, I wanted to pass on the fact that trading is a profession, just like any other traditional profession and as such should be run with a strict set of business operation rules. This is without a doubt the most neglected aspect of trading and is the reason 80-90% of traders fail when it comes to successfully trading or speculating in the markets. Therefore, my first intent is to show that there is a science to running this type of business, the same as in any other traditional business. Second, I attempt to logically show that there is also a science to the task of selectively trading in the various markets, the knowledge of which reduces the level of risk in trading to a level comparable with all other lines of business. There are very few books on these subjects even though they are the most critical factors in prevailing in the markets. Without this knowledge, a trader is like a chicken running around without his head. He may keep his feet moving for a while, but his outlook is easily predictable. What I have to share is not a “system” by today’s computerized definition of the word. I present the essential elements needed to succeed no matter what approach is used. Without these elements, failure will occur eventually. Yes, there is a systematic procedure that must be followed, but it is not a so-called trading system. I present methods and techniques that I have personally used to make money from the markets, but like any strategy or approach, it would eventually lead to failure without a strict set of business management rules.

TRADING IS A PROFESSION

Trading is a profession and nothing less. Most professions such as medical, legal, psychological, pharmaceutical, technical, mechanical, engineering, etc., require several years of education, study and effort. Not to mention the money required for learning the necessary skills. Then it takes many more years of actual practice to develop the skills and gain the experience to become successful. It is ironic how many of these same professionals attempt to become successful traders without even the slightest knowledge of the markets or more importantly, money management principles. This occurs because there are no barriers to entry in this business. If you want to enter this profession, you just need a few extra dollars to open an account and that is it. However, if you wanted to become a doctor or a lawyer or enter some other profession, you would have to pay for an education, study hard, take tests, and obtain a license, etc., before you can even have the opportunity to find a job or start your own practice. This same principle applies to going into business yourself. Even if you wanted to simply open up a party store or a pizza shop, you would have many barriers to entry. This is not true with the trading business, which is another reason so many people fail.

CHARTS

Charts are utilized because they reflect the underlying psychology of all the participants involved and provide a past record of important price levels. Although many traders today rely entirely on computer-generated charts from various programs, I feel that subscribing to a printed chart service proves to be worth much more than the annual cost involved. By having a subscription to a chart service, you will find many more opportunities in markets that you may have completely overlooked due to a lack of interest. The trading business is just like any other business; you do it to make money. Receiving a regular set of charts on the various markets once or twice a month will provide you with many different perspectives (daily, weekly, monthly) that may expose opportunities that are simply much too good to ignore. In addition, you gain a feel for how the various markets are playing off one another.

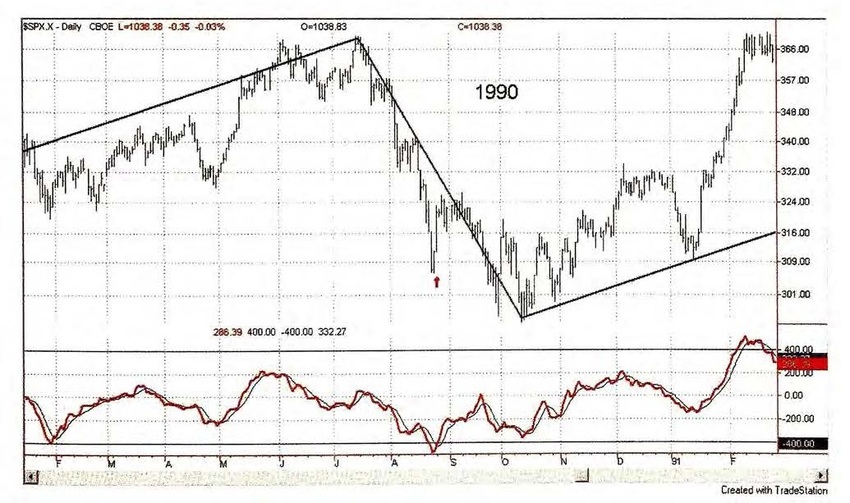

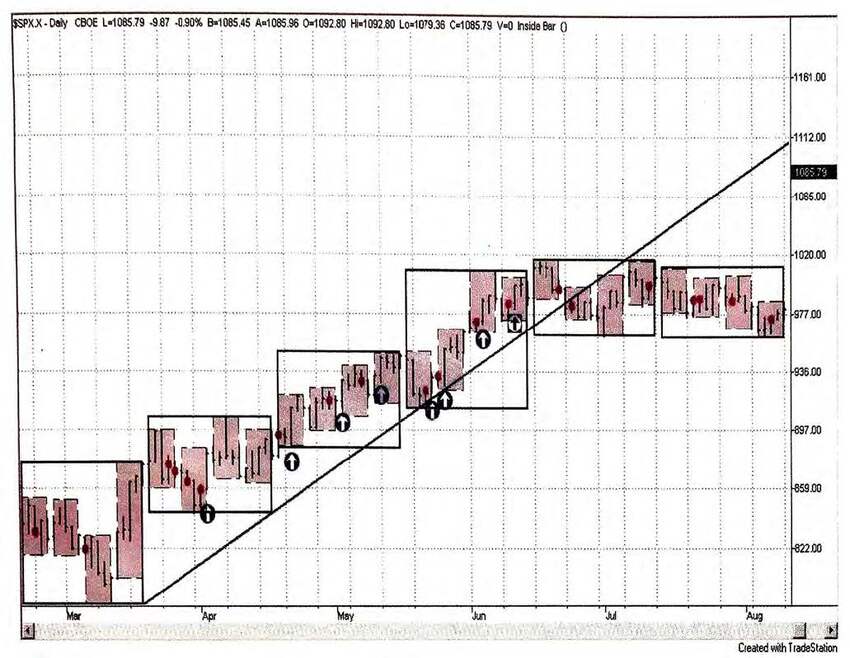

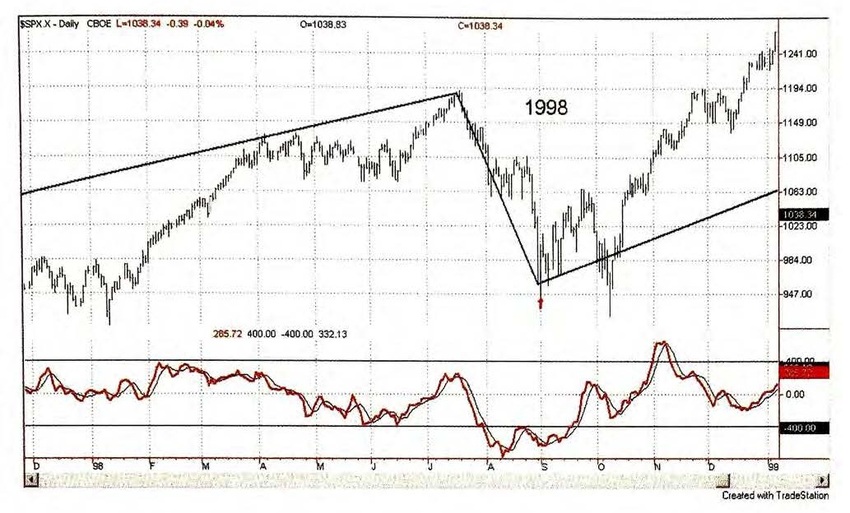

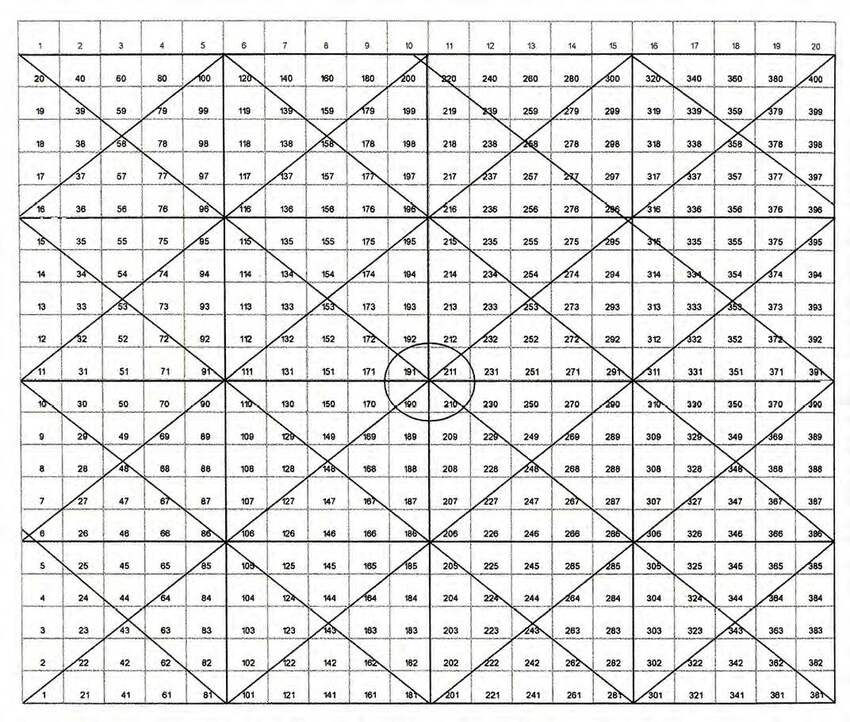

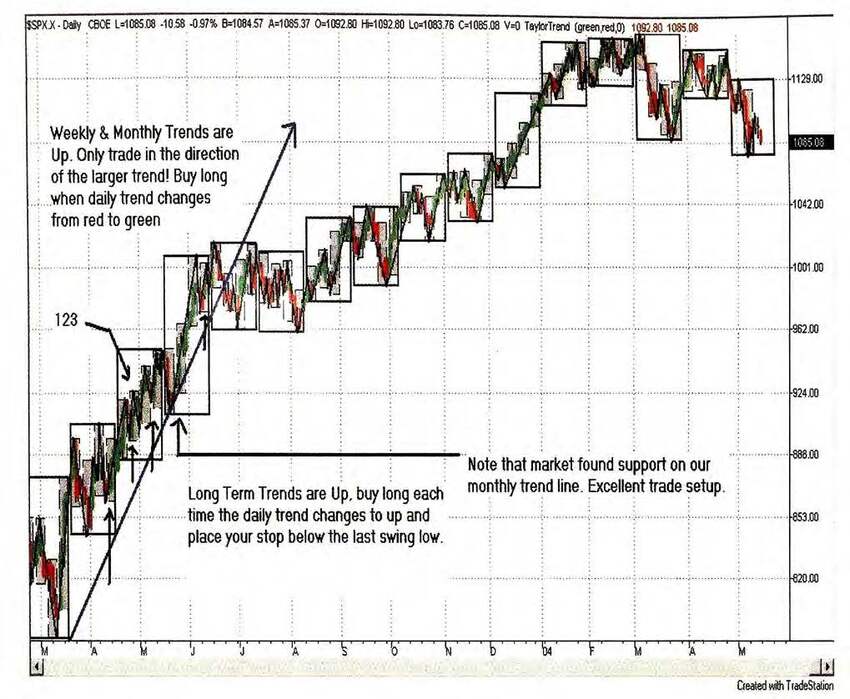

Some Pictures From the Book

Hand charting is a dying art form due to computers and chart publications. Maintaining a set of hand drawn charts on your favorite markets is strongly recommended! It takes very little time each day (only a few minutes) to update these charts. By doing so, you become much more mentally connected to the market and will have little difficulty in remembering important prices. Hand charting makes you much sharper and more alert to upcoming opportunities. It also gives you a better feel for the market that can develop into a type of intuition, which cannot be obtained by any other means. I have even gone as far as drawing intra-day charts by hand. I suggest that you resurrect this lost art if you are truly serious about taking on the trading profession.

In summary, charts are used extensively because they are the best graphical representation of human logic and emotions. They show us visually the cumulative effect of all the participants involved. Charts also expose potential opportunities that might have otherwise escaped your attention. Hand charting connects you to the market more so than simply reading a chart. There is a certain level of expertise that can only be acquired from the manual process of drawing a chart. Markets are like people; each has its own personality, habits and nuances. Your hand drawn charts will become your encyclopedia of knowledge of the market’s action.

Charts are much more than a simple history of past prices. They reflect and depict the ideas, actions, reactions, and emotions of the traders commercial interests and speculators involved. If you want to write like someone in particular, just begin copying their work verbatim a few times, and you will develop a feel for their writing style. If you want to paint like someone in particular, simply trace their artwork several times and you will develop similar skills and again obtain a feel for their style. Drawing charts by hand accomplishes this same intuitive feeling for the markets. This is not a requirement for success, but it is something that you should do as a standard operational procedure. Just because there are more efficient methods to get the task done does not mean they are superior! Try hand-drawing charts of the markets you are interested in for at least 2 months and I think you will be more than convinced of their value.

| Author | Daniel T. Ferrera |

| Pages | 150 |

| Published Date | 2015 |

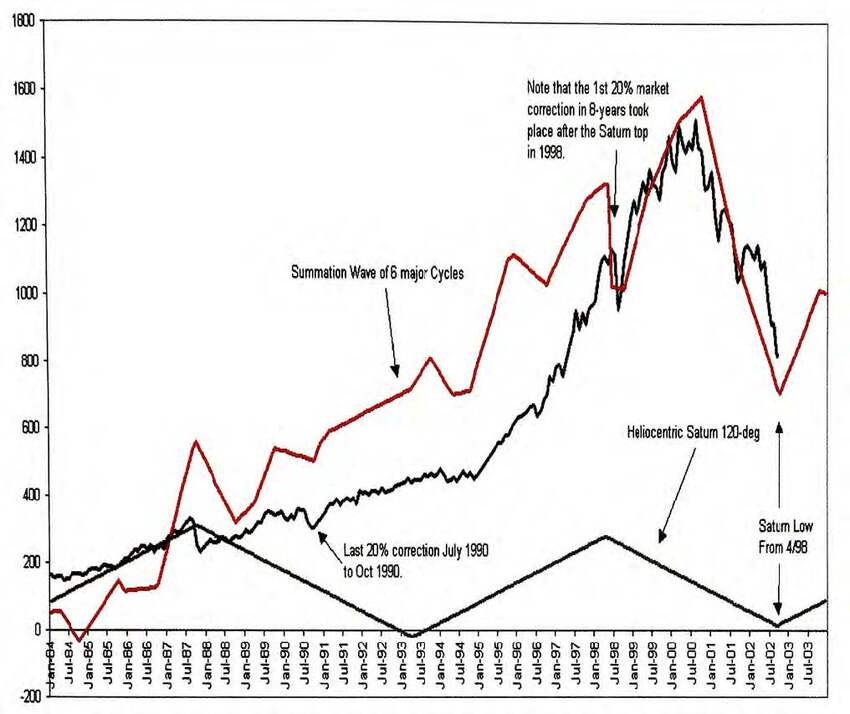

Some Pictures From the Book

TABLE OF CONTENTS

- Trading is a Profession

- A Word About My Writhing Style

- Charts

- How Much Do You Need to Start Correctly

- Commodity Basics.

- Risk Disclosure

- The Most Neglected Trading Discipline

- W. D. Gann’s Most Important Money Management Rules

- Understanding the Basics

- Understand Trends and Trend Line Breaks

- Market Swings

- Support and Resistance

- Short Term Consolidation Patterns

- Trends Again: Bar Grouping Technique

- Swing Trading: A Quick Word about W.D. Gann

- Explaining Gann’s 50% Rule

- Gann’s Red Light Green Light Indicator

- ABC’s & 123’s

- Putting it all Together

- Using Inside Bars to Enter in the Direction of the Larger Trend

- Understanding the Options Opportunity

- Timing Important Stock Market Bottoms

- Successful Trading

- What is Luck?

Gann for the Active Trader: New Methods for Today's Markets by Daniel T. Ferrera