Articles

Fibonacci and Gann Applications in Financial Markets: Practical Applications of Natural and Synthetic Ratios in Technical Analysis

There are many books covering Fibonacci from an artistic and historical point of view and almost as many suggesting that Fibonacci retracements and numbers can be successfully applied to financial market time series. What is missing is a book that addresses the common errors in using screen based Fibonacci (and Gann and other tools).

The book is a critical exploration of Fibonacci numbers, retracements, projections, timeframes and fanlines and their current usage within the financial markets by technical analysts. Although they can be extremely effective analytical tools when used appropriately, mistakes in usage can be extremely costly from a financial and credibility viewpoint. George MacLean takes a brief look at the history of Fibonacci and Gann, before providing a full account of their applications in financial markets, including fixed income, equity, foreign exchange, commodities and indexes. In particular, he draws attention to the overuse and misuse of easily applied computer packages available to professional and amateur traders.

Author’s Note:

Technical analysis is not a difficult subject for study, but it does suffer from a bad press from time to time. It attracts strong personalities, as it is a very small pond and strong characters tend to stand out more and get heavy coverage in the media; we can suffer from the bad press by having far too many technicians saying they forecasted various key corrections in the past. These boasts have to be taken with a pinch of salt. Publicity for technical analysis in the media is a good thing as technical analysts are not shy and tend not to hide under bushels. However, within our own community the real stars are the quiet ones who do sterling work and research day in, day out with little or no acknowledgement.

These are the experienced analysts who take time to dispense their accumulated knowledge of market analysis and strive to further the bounds of technical education and study. Market understanding has fallen out of favour in recent years as traders shrink the timeframes necessary for a profitable trade. However, that was fine in the bull market times, but is much more difficult in choppy bearish ones. Anyone can catch the trend from simply looking at a screen, but it takes a trained eye to spot when an asset price is running out of steam and indeed looking risky.

It is in such situations that the skills of a good technical analyst come to the fore. In the last 20 years the study of technical analysis has become more formalised. In the past, charting and interpretation skills were passed on from individual to individual or perhaps even picked up from the plethora of business biography books available. However, this is not an ideal situation and a more formal approach is needed. It has been with the networking of analysts regionally and globally that has seen the development of training courses, seminars and even television training. It is to this corpus of information that this book hopes to add.

When I started out as a trainee technical analyst I was never allowed to act on any of my analyses until I had proved myself with a professional qualification in technical analysis, so my learning was bookish and dry and suffered from lack of practical application. However, subsequent employment opportunities gave me practical skills that cannot be found in any of the more traditional textbooks. Practical technical analysis is quite different from a bookish one – the sheer volume of instruments that have to be analysed on a daily basis, coupled with constraints on time, which mean that not all studies have the time to be drawn, means that the contemporary technical analyst has to be knowledgeable as to when to cut corners, and more importantly when not to.

Traditional paper charting days are gone, as is the gentle skill of taking time to look at trend, pattern and Point and Figure charts and taking a measured long-term view. It is not uncommon for a technical analyst today to consider the long-term view as being until lunchtime. Screen-based charting and price information have allowed this shortening in timescales to develop, but not without some cost. Long-term studies of any financial market are few and far between.

It is only through continued practice and study of new techniques and reviews of old long-learned ones that technical analysts will improve their skills. Technical analysis is not a Dark Art practised by very few acolytes; it offers skills and opportunities to look at markets from both a scientific and an artistic bias, as true technical analysis is a porous membrane between science and art and both skills are needed if the technical view is to be successful.

This book looks at the application of two of the more ‘obscure’ techniques, Fibonacci applications and Gann theory. Both of these techniques have a long and glorious application history, but it is the careful application of these techniques that has been overlooked now that many charting packages conveniently draw the various patterns on a screen. This book looks at the drawbacks of this convenience and points the student of technical analysis in the right direction and hopefully encourages good technical practice.

While it can be enough to take positions on Fibonacci and Gann analysis alone, it would be seriously wrong to overlook other technical tools. There is a chapter that looks at ‘Total Analysis’ (Chapter 8) where a sequence of analysis tools, which give a better understanding of the outlook, is suggested.

Contemporary technical analysts stand on the shoulders of giants in our field, and I am fortunate to have met and studied and practised under some of the greats. Bronwen Wood FSTA started me off in this field and her lectures were inspirational. She is greatly missed. Tony Plummer, who turned me from technical analysis of equities to Gilts, can take the blame for my subsequent career. Thanks are also due to Gerry Celaya for showing me how not to be frightened by either intraday charts or Fibonacci tool attack and my fellow board members of the Society of Technical Analysts, especially John Cameron FSTA for encouragement.

Finally, to the stars and giants of the future, this book is addressed to you.

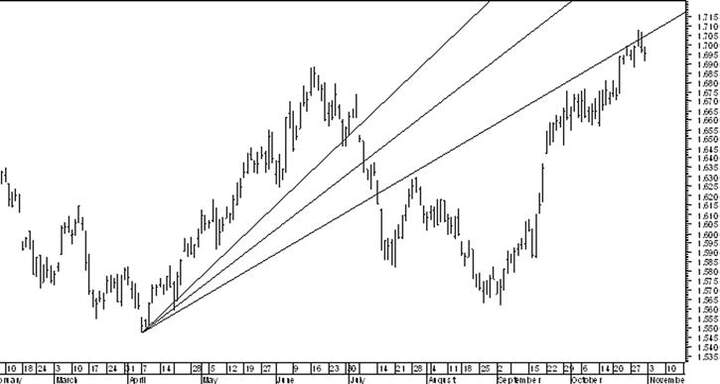

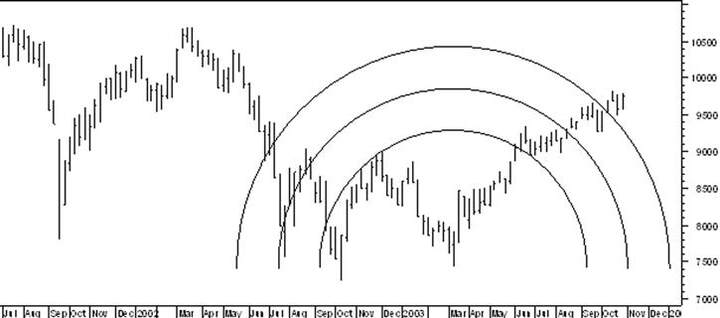

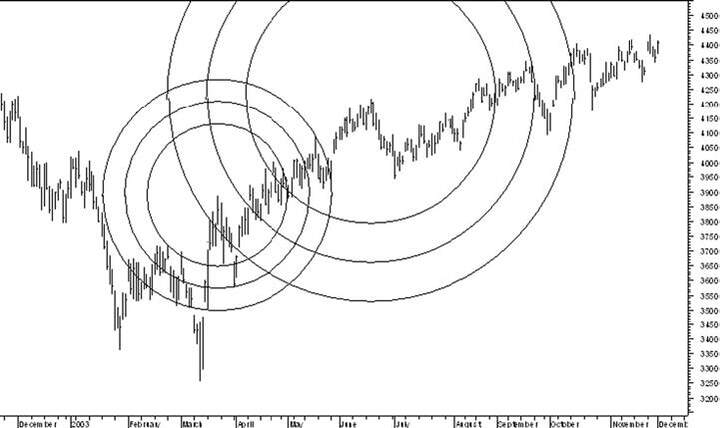

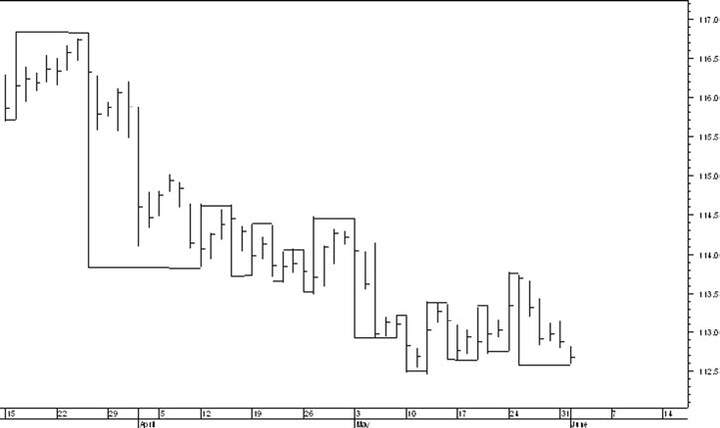

Some Pictures From the Book

| Author | George MacLean |

| Pages | 240 |

| Published Date | 2005 |

Table of Contents:

- Introduction to and History of the Fibonacci Sequence

- Application to Financial Market Analysis

- Other Applications of the Fibonacci Retracements and Extension

- Charting and Difficulties: A Historical Perspective

- Common Errors in Application of Fibonacci Retracements and Extension

- Application and Common Errors in Fibonacci Fanlines

- Application and Common Errors in Fibonacci Timelines

- Total Analysis – Pulling All the Skills and Techniques Together

- Gann, The Misunderstood Analysis

- Other Interesting Studies Using Synthetic Ratios

- Conclusion

Fibonacci and Gann Applications in Financial Markets: Practical Applications of Natural and Synthetic Ratios in Technical Analysis By George MacLean