Articles

ABC’s of Gann & Fibonacci: Advanced & Basic Charts

Introduction:

Who was W.D. Gann? W.D. Gann has arguably contributed more to Technical Analysis, and in particular the understanding of the relationship between Time and Price, than any other person that traded the world markets. It was Gann’s mathematical genius and his ability to see the patterns in the market (that at the time nearly everyone else ignored) that made him so successful and has a legacy that continues to this day. William D. Gann was born June 6, 1878 in Lufkin, Texas. His father was a cotton farmer in Texas. Growing up on a cotton farm, young William began calculating times of the year when cotton was at its best price and suggested to his father not to sell at harvest. As his theories proved successful, he moved on to other commodities and began experimenting with historical data.

He started trading in 1902 when he was 24. He was believed to be a religious man by nature who believed in religious as well as scientific value of the Bible and spoke of it as the greatest book ever written. This can be repeatedly observed in the books that he wrote over the years. He was also a 33rd degree Freemason of the Scottish Rite Order, to which some have attributed his knowledge of ancient mathematics. He was also known to have traveled many places like India and Egypt and studied the ancient Greek geometry along with the Indian and Egyptian cultures. It is believed that during this time on his journeys, he discovered the “Square of 9”. He called this the “SPIRAL CHART”. I will cover this in a later chapter.

Gann used ancient math and geometry (geometric angles) on his charts and described the use of angles in his book The Basis of My Forecasting Method (1935). There has been a general disagreement whether he made profits by speculation himself. However, his famous Ticker Interview[11] shows that his claim to profits was as real as his documented forecasts.

As you will see later in this book, his forecasting methods are still valid. His most effective tool was the Square of Nine (Spiral Chart). People have asked me how Gann Angles are going to help in their trading? And how this Gann Math is going to blend in with the type of trading they do? My answer is the simple techniques I teach in this book are no more difficult to learn than Moving Averages or Stochastics or the RSI. I know there are people who trade on these alone and hope that these basic tools will to bring them to riches. Moving Averages alone are not a formula for success. Truth of the matter is, most Moving Average systems are 50% accurate at best. It is better to flip a coin and call it.

One grain broker told me back in the early 1980’s, he had a spinner on his desk which divided the circle into 8 equal segments. Every other segment was BUY – SELL- BUY…etc; When a client called, and asked the broker which way he thought the market was going that day, he would flip the spinner with his index finger and pass his wisdom onto the client. He had a 50-50 chance of being right and in the mean time, he received a commission from it. Believe it or not, people like this do exist.

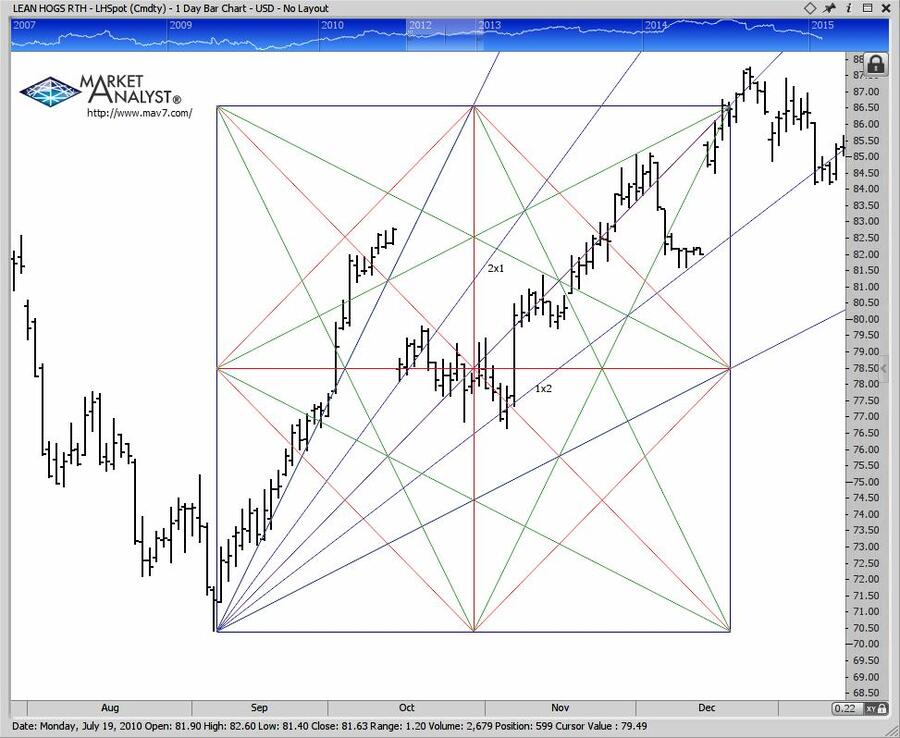

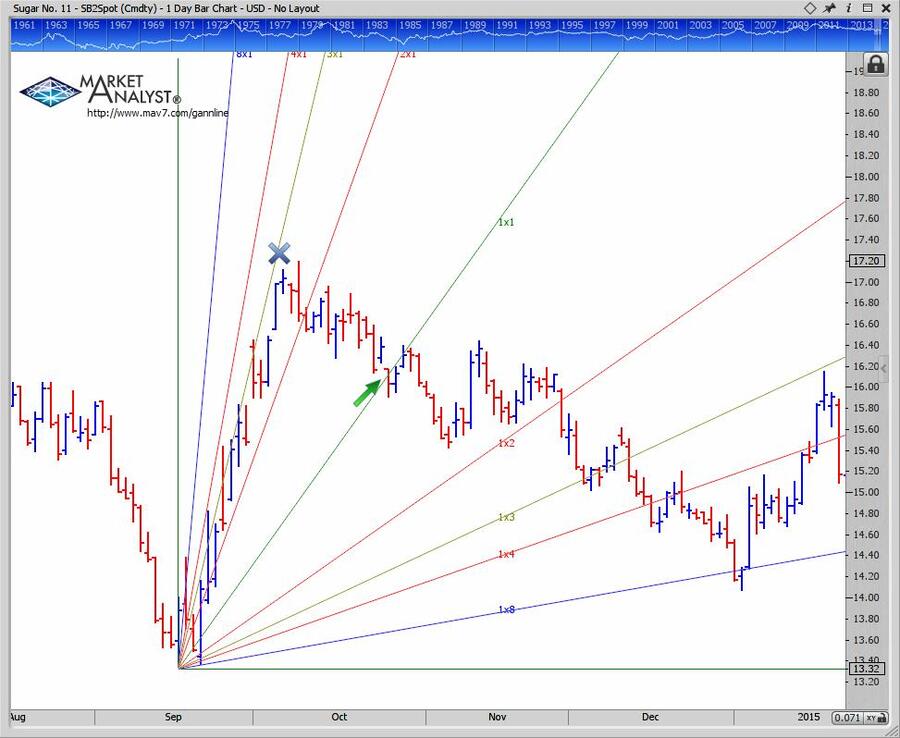

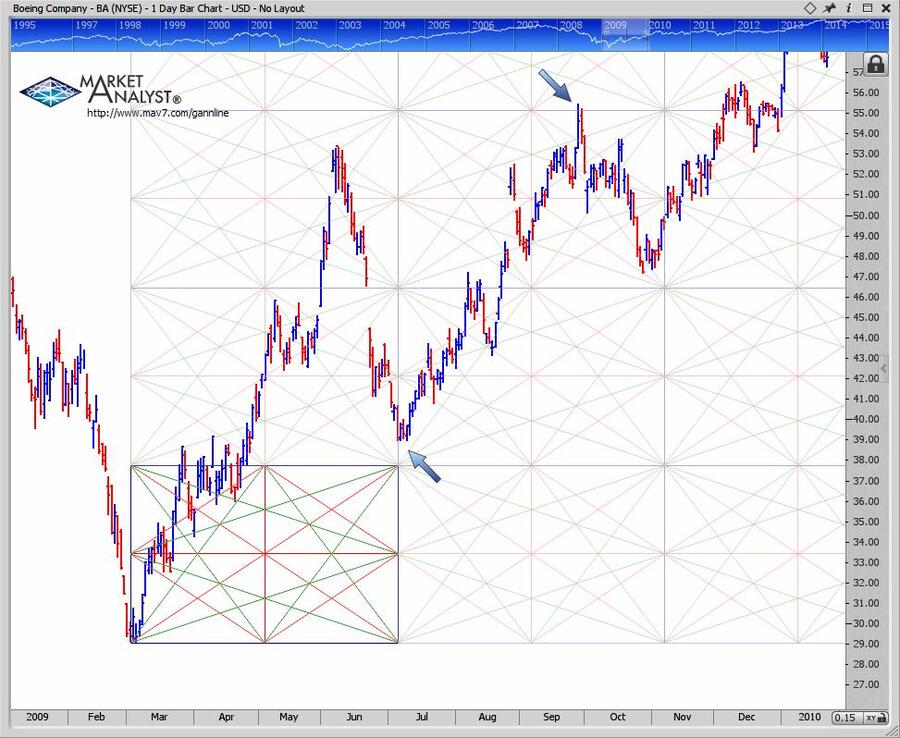

Some Pictures From the Book

Bottom line is, if you want to get serious about a business, you must do your homework. Trading Stocks, Commodities, Forex or any market for that matter, is no different. You must dive in and get your hands dirty (so to speak) and do some work. You must have a Plan of Action. When Angles are used to analyze any market, it is like building the wooden frame of a house on a foundation. The foundation is already laid in the form of Market Movement captured on charts. It is my intention to reveal to you how this frame work can be used as a tool for showing timing points for trend change and support/resistance levels.

In the early 1980’s I attended a Larry Williams seminar trying to obtain some of his wisdom in trading the commodity markets. I left that seminar with an indelible mark on my memory. The one statement he made that stands out most in my mind was his description of the commodity markets. He said, “The commodity markets are like a roaring tiger stalking around looking for prey. The trader is like a hunter with a single shot rifle. He has one shot and it better be a good one or the tiger will pounce all over him”. I think that sums up today’s markets in a nut shell.

The point is you better be prepared to exit stage left just in case your single shot missed, (your analysis was wrong). I don’t know about you, but I want that door on the left side of the stage to be as close as possible. I do not like to risk a lot of money on any trade. Getting in the market at the point of least exposure is one of my goals and it should be for every trader. How do we accomplish this goal? Well, in this book, I hope you will find the answer to that question through the guidelines provided which show the least amount of exposure to your trading account and to find your comfort zone.

| Author | Gene Nowell |

| Pages | 151 |

| Published Date | 2015 |

Table of Contents

- 1.) The Gann Scale

- 2.) Applying Angles to Charts

- 3.) Swings and Angles

- 4.) Angles of Support/Resistance

- 5.) Applications & Strategies

- 6.) Types of Squares

- 7.) Harmonic Numbers

- 8.) Trendline Indicator

- 9.) Square of 9

- 10.) Market Science & Behavior

- 11.) Gann’s Rules for Trading

- 12.) Money Management

- 13.) The Fibonacci Spiral & Golden Ratio

- 15.) Entering a Trade Larry Williams way

ABC's of Gann & Fibonacci: Advanced & Basic Charts By Gene Nowell