Articles

The Master of Time, An Epos of W.D. Gann’s Master Time Factor

Introduction:

William Delbert Gann (1878-1955) was an enthusiastic person. This was not only expressed in his investing and the studies he made about the economic markets but also in his religious ideas. Gann was an eager Christian. His passion was always his trademark. It was Gann’s opinion that you had to be intensely passionate about what you wanted to achieve; otherwise success wouldn’t come to you. With this he “extends you his hand” and sends you out to discover for yourself: he only names ‘the topic’. As reader you are forced to think for yourself. He lures you into discovery. You need to discover for yourself if what he says is correct. For a number of theories he has never revealed his secret recipe. One of these theories is The Master Time Factor.

It is a mathematical calculation that explains the natural wave movements on the markets. On one hand he was very secretive but on the other hand he was also very open about his theory. Hard work and intensive study is needed, according to Gann (appendix: Ticker Interview 1909). After his death his belongings showed how fanatical he was about the markets. Thousands of graphs were found with lines, numbers and all sorts of notes written upon them. Gann had studied the charts from the very beginning; he was of meaning that everything in life repeats itself. The answer to future market developments can thus be found in the market development of the past.

Gann’s philosophy can also be traced to the social-economics theory of human behaviour. According to Gann wave movements on the market can be predicted, because human behaviour never changes. People cherish hope and hope is confirmed when rates rise; giving people faith in their own behaviour. But, people also have fears; fear of losing their values and fear confirms lack of faith. This is a continually reoccurring theme according to Gann.

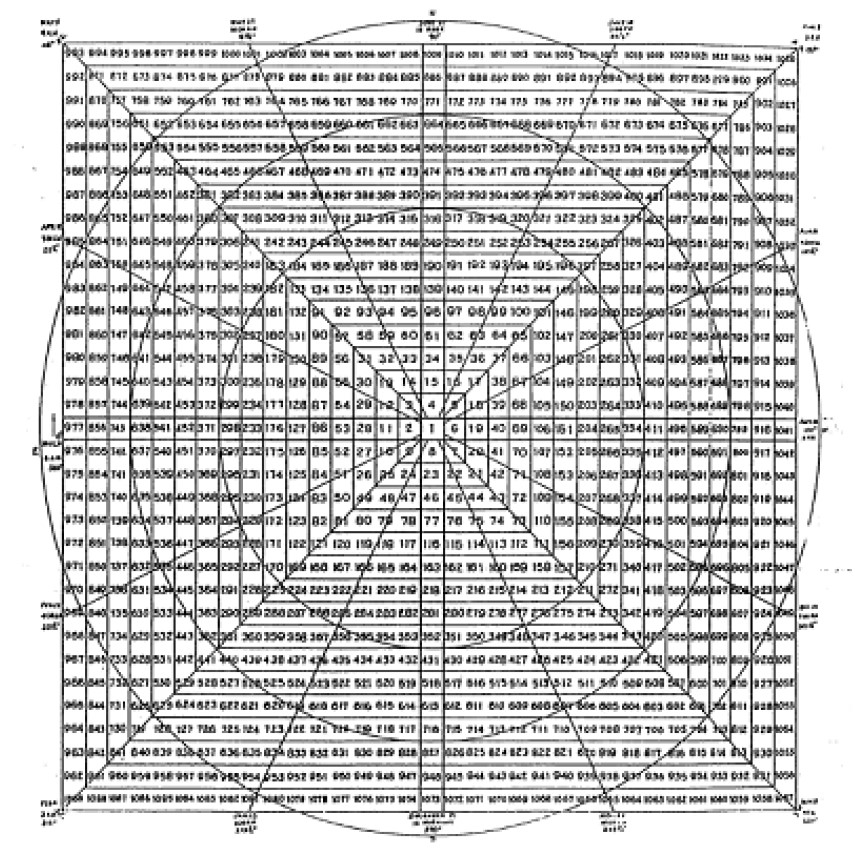

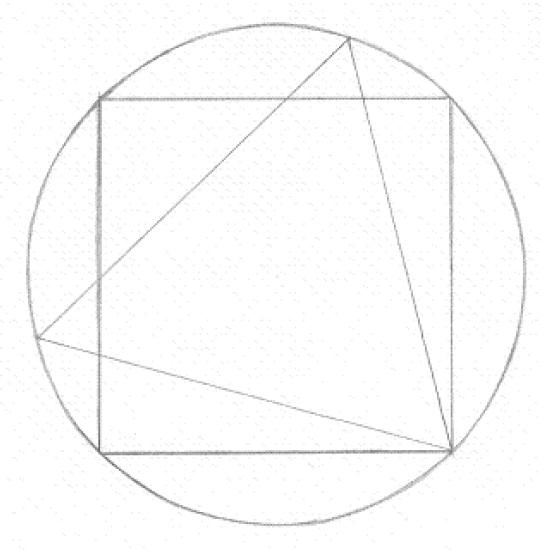

Gann’s work can best be described as a study of “natural movements”. Harmony in relationships, in units and in the line game: symmetry and geometry. Even with the craziest of things you can be sure that Gann had experimented with it. He studied the market movements with figure patterns (numerology) but also with geometry (lines). He based his investing theory on ancient texts, such as the Old Testament, the Kabala and the Veda’s. He translated the Bible’s mystics into numerology; which he not only used on the markets but also on political and economic grounds. It is said that the secrets he wrote in his book “Tunnel through the air” were written in code. The book is written as a novel and takes place during the Second World War. Many have studied the book and written about it. More have discovered valuable elements in Gann’s work but have never made it public.

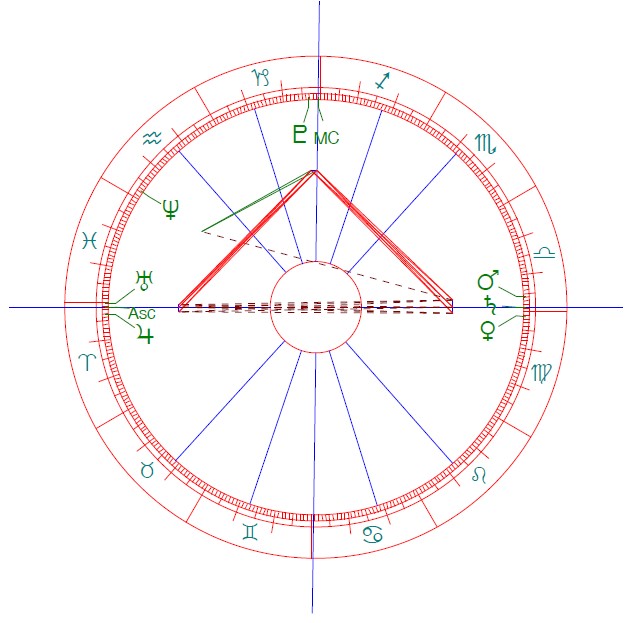

Gann sees the markets as a geometrical and harmonious coming together of movements (angles) in time and price. He looks at it in a very holistic way. During his travels to India and Egypt he studied symbols and ancient cultures. His studies of the Old Testament also indicate that Gann looked at market movements with a holistic perspective. Movements follow in a logical manner and stand respective to each other. Even though Gann’s theories are made up of a lot of mathematical modules, here in also shelters the pitfall. If we want to look at market movements through the eyes of Gann then we shouldn’t make calculations and statistical chance calculations in the ways an accountant would. Doing this would completely make a knot of things. The numbers (usually years) indicate important periods wherein similar market movements should be found. Yes…should! We have to use our imagination in order to understand the movements on the markets. It is as if Gann refers to totally different things: especially as he wrote it in a sort of secret code; in a number of interviews he stated that he wasn’t willing to sacrifice “his little secret”.

In my opinion I think that we have to handle Gann’s methods playfully. It concerns relationships, which give expression to human trading. It comes down to the fact that no single movement is an exact replica of a previous movement, despite the great comparability. The moment we follow Gann’s theories to the letter we get stuck, as the human factor cannot be shown within the lines.

Market movements are not evenly divided into tops and troughs but always reveal a different pattern. We can observe this if we lay equally divided wave movements over share market charts. A well-known wave movement cycle is the four-year cycle, but if we lay the cycle pattern over the tops and the troughs of the actual market then we see that one time this four-year cycle is a little longer than 3 years and another time a little shorter than 5 years. The average is four years but it is very difficult to decide where the next top or bottom will lie. The market movements look a lot like each other but the size of them varies. Put in another way: the one impulse wave (Elliott) is not the other, but they are all impulse waves. This is also how Gann looked at the market. The repeating wave movements are not all alike but they are all still wave movements that are repeated. I say again: without imagination we will not understand the market. Use this capacity in yourself to understand what market development has in mind. It was after all Gann who strayed from the beaten track.

| Author | Victor Ledeboer |

| Pages | 112 |

| Published Date | 2009 |

Some Pictures From the Book

Table of Contents:

- W.D. Gann’s philosophy: The master investor

- The past repeats itself: Because human behaviour never changes

- The inner and outer cycle: Time and price levels

- Chronos: The Time warrior

- The great Chronocrators: Factoring the Time

- The new time: Looking forward

- Conclusion

- Appendix 1 THE INVESTOR

- Appendix 2 CYCLES

- Literature list

- Ticker interview

The Master of Time, An Epos of W.D. Gann’s Master Time Factor By Victor Ledeboer