Articles

The W.D. Gann Method of Trading: A Simplified, Clear Approach

Introduction:

”You can make a fortune by following this one rule alone. A careful study and review of past movements in any commodity will prove to you, beyond a doubt, that this rule works, and that you can make profits following it.”

How to Make Profits Trading in Commodities, 1942, p. 36

Any trader, from the novice to the professional, who is aware of the futures markets knows that tremendous profit potential exists in trading futures. Yet, it seems almost impossible to learn all the trading rules and “caveats” of futures trading, and then to put them into practice. A computer and software can give a trader many advantages. Automated data retrieval, stochastics, RSI calculations, and Elliott Wave counts can all be done in minutes, rather than hours, with less work and greater accuracy.

A beginning trader, though, may not own a computer. It may be a costly and time-consuming effort, sorting through the maze of investment software, plus the numerous technical-analysis methods and “systems” that are offered today. Terms such as extended 5th waves and oscillators, and the names of Fibonacci and Wilder, may be completely foreign to the new trader. Systems with exotic names, all of which seem to promise wealth, only add to the confusion. The new trader looks for something that is clear, simple and easy to understand; some trading method that can be used to increase a trader’s confidence – and a trader’s account.

This book was written to give a new trader answers and information. It does not contain a sure-fire method of making a fortune overnight. It DOES present guidelines to help the beginning trader earn consistent profits, while answering some of his questions. The guidelines are based on established rules that are surprisingly simple, yet dramatically effective for profiting from the markets. The rules follow the “KISS” axiom of Keep It Simple, Stupid. They have stood the test of time for any market, for any period, and for any amount of capital the trader wishes to risk.

The rules are based on Gann’s 50% Retracement Rule.

William D. Gann was a trader of the early 20th century. His abilities for profiting from the stock and commodity markets remain unchallenged. Gann’s methods of technical analysis for projecting both price and time targets are unique. Even today, his methods have yet to be fully duplicated. Known as “The Master Trader:’ W. D. Gann was born in 1878, in Lufkin, Texas. Gann netted over $50,000,000 from the markets during his trading career, averaging a success rate for trades of 80% to 90%. It has been said that Gann could very well have been right ALL the time. Any losses incurred by him were only there by his own design and not because of any faults with his methods. His successes are legendary. Gann literally converted small accounts into fortunes, increasing their net balances by several hundred percent. There are numerous examples of his trading successes, among which are these:

- 1908 – a $130 account increased to $12,000 in 30 days.

- 1923 – a $973 account increased to $30,000 in 60 days.

- 1933 – 4 79 trades were made with 422 being profitable. This is an accuracy of 88% and 4000% profit!

- 1946 – A 3-month net profit of $13,000 from starting capital of $4500 – a 400% rate of return.

The following paragraph appeared in the December 1909 issue of “Tickee, Magazine. It was written by R. D. Wyckoff, the former owner and editor of the “Ticker,” and describes Gann’s proficiency for projecting price targets forward in time:

“One of the most astonishing calculations made by Mr. Gann was during last summer (1909) when he predicted that September Wheat would sell at $1.20. This meant that it must touch that figure before the end of the month of September. At twelve o’clock, Chicago time, on September 30th (the last day) the option was selling below $1.08 and it looked as though his prediction would not be fulfilled. Mr. Gann said, ‘If it does nottouch$1.20by the close of the market, it will prove thatthere is something wrong with my whole method of calculations. I do not care what the price is now, it must go there.’ It is common history that September Wheat surprised the whole country by selling at $1.20 and no higher in the very last hour of trading, closing at that figure.”

Gann’s trading methods are based on personal beliefs of a natural order existing for everything in the universe. Gann was part of a family with strong religious beliefs. As a result, Gann would often use Biblical passages as a basis for not only his life, but his trading methods. A passage often quoted by Gann was this from Ecclesiastes 1:9-10:

”What has been, that will be; what has been done, that will be done. Nothing is new under the sun. Even the thing of which we say, ‘See, this is new!’ has already existed in the ages that preceded us.”

This universal order of nature also existed, Gann determined, in the stock and commodity markets. Price movements occurred, not in a random manner, but in a manner that can be pre-determined. The predictable movements of prices result from the influence of mathematical points of force found in nature. These points of force were felt to cause prices to not only move, but move in a manner that can be anticipated. Future targets for both price and time can be confidently projected by reducing these mathematical points of force to terms of mathematical equations and relationships.

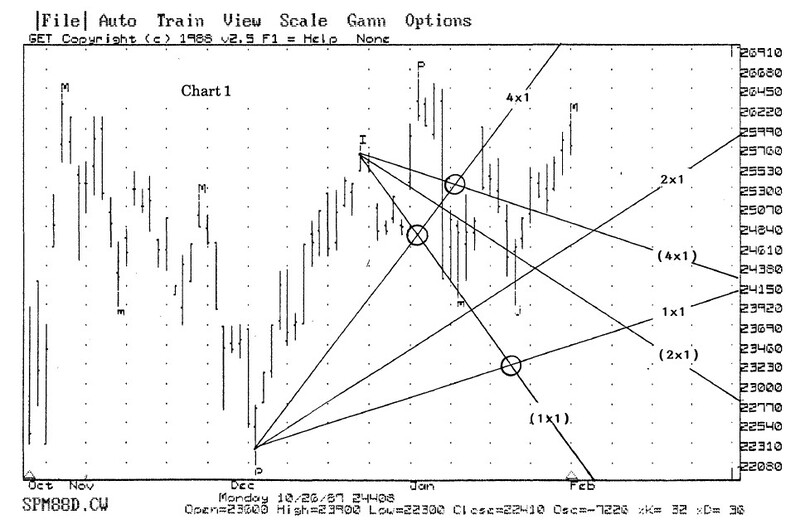

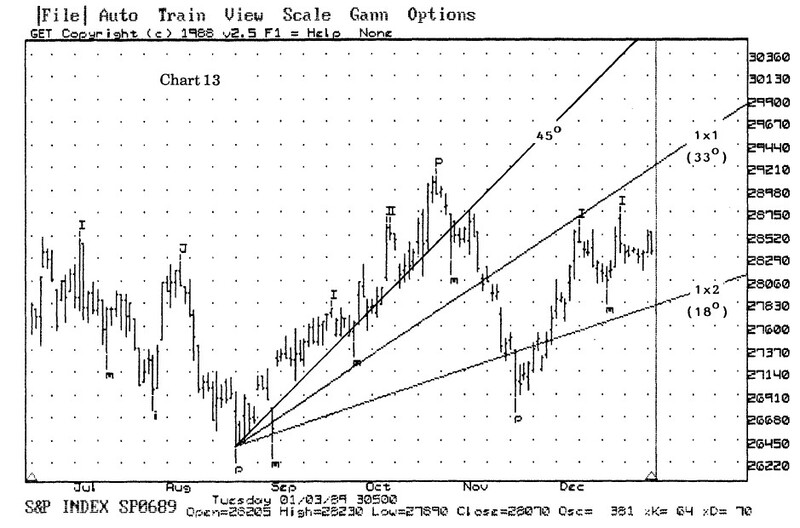

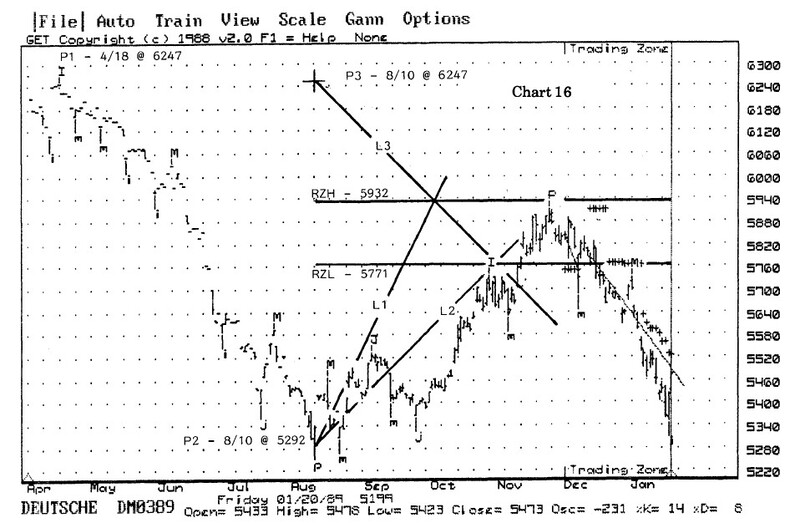

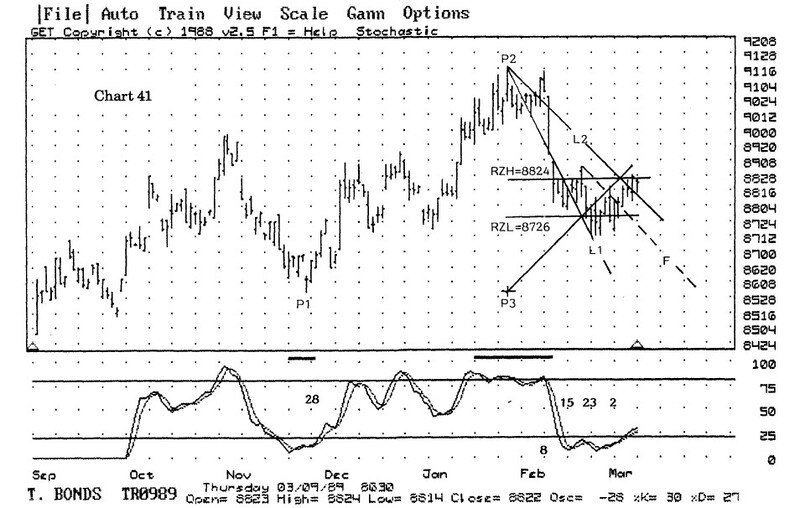

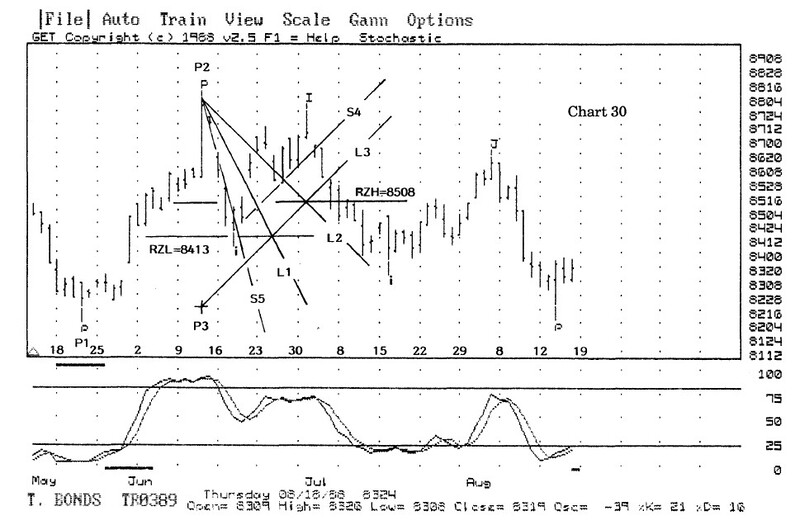

The mathematical equations of Gann are not complex. They result in lines of support and resistance which prices invariably will follow. The intersection of these lines of force, called Gann Lines can pinpoint when a price reaction will occur, while others will reflect at what level price reactions will occur.

| Author | Gerald Marisch |

| Pages | 210 |

| Published Date | 1990 |

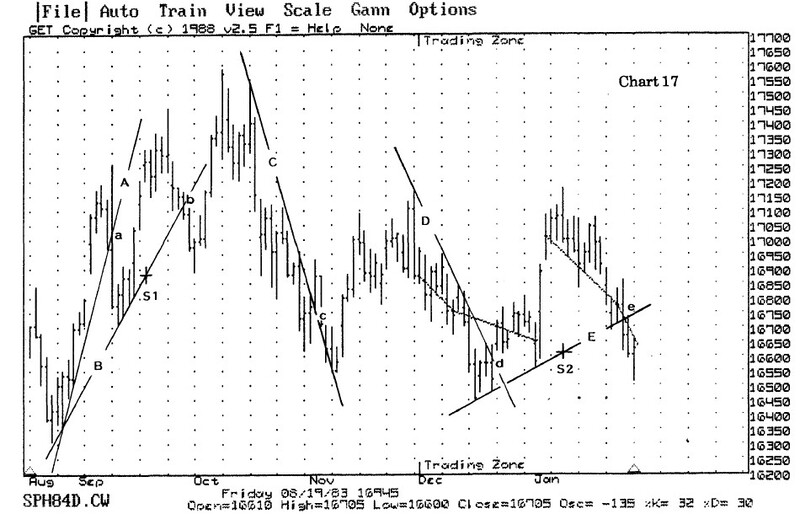

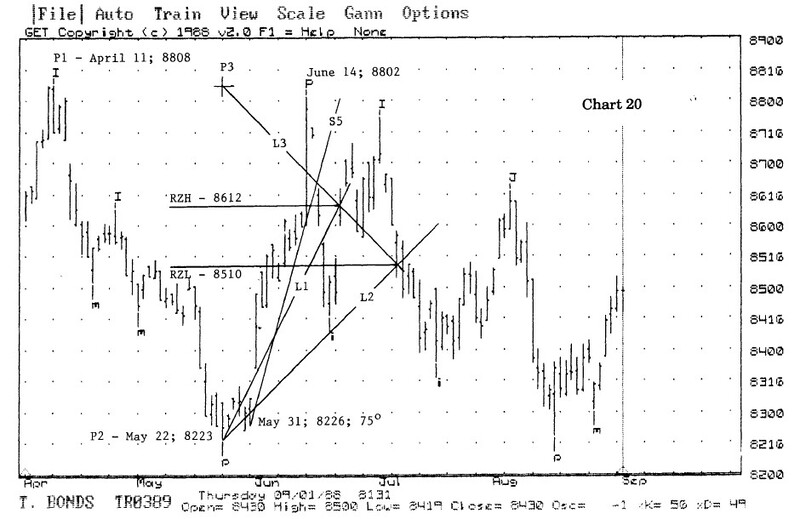

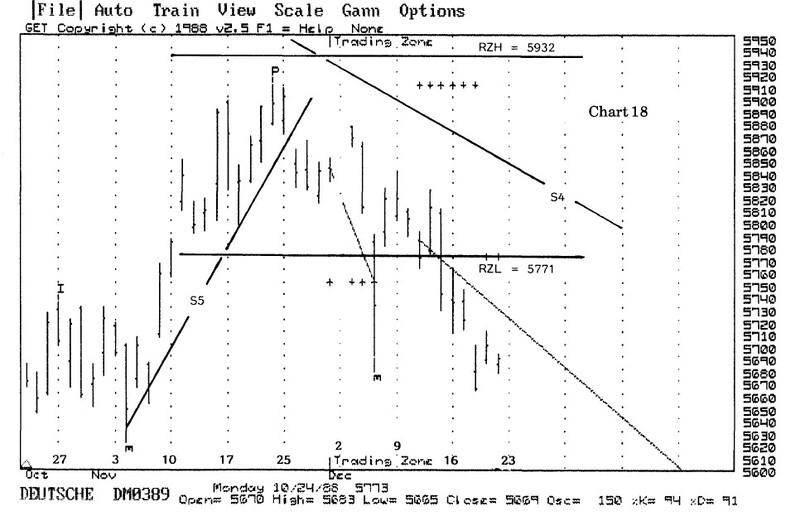

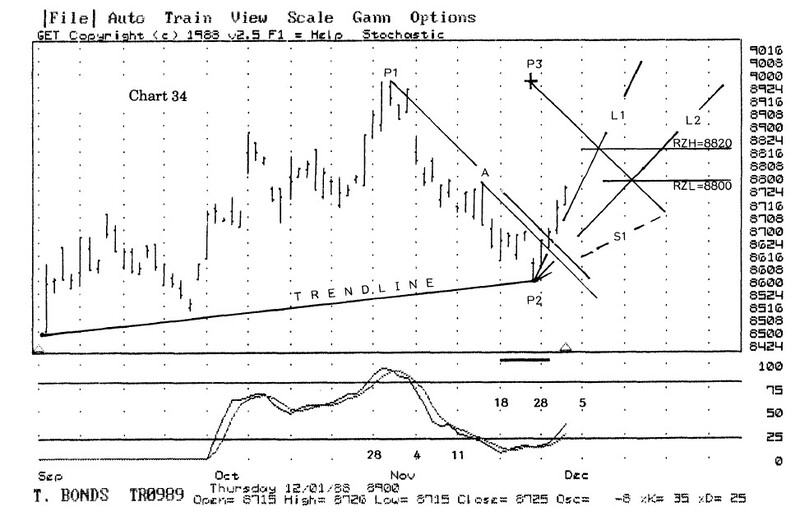

Some Pictures From the Book

Table of Contents:

- Gann … His Rules and His Angles

- Time

- Price

- Retracements

- Gann Angles – Price versus Time

- Gann’s 50% Retracement Rule

- Definitions

- Establishing a Retracement Zone

- Stop-Loss Orders

- Liquidation in the Retracement Zone

- Stop Order

- Market Order

- Stop AND Market Order

- After Profits … Now What?

- Fine Tuning the 50% Rule

- A Word about Stochastics

- What to Trade – United States Treasury Bonds

- Putting It All Together

- Does It Work All The Time?

- Getting Started

The W.D. Gann Method of Trading: A Simplified, Clear Approach By Gerald Marisch