Articles

Unlocking W. D. Gann’s Methods: How Gann’s Methods Are Applicable to Today’s Trading

THIS BOOK IS WRITTEN FOR those who see the sense and logic in the principles of W. D. Gann’s trading but have difficulty applying his rules to modern-day trading. If you have not read any of Gann’s books that were written in the first fifty years of the twentieth century, then you will probably find this a very difficult read. You still could read chapter 5, where I give you the walk-through of how to trade Netflix in the recent bull run and copy the method, but it would be unfair to the legendary trader Gann because I did not invent anything new. I only applied his principles and his method.

Gann set up his firm Gann-Lambert publishing, and they sell the original Gann books. I present the reading list in the back of the book, and you can purchase the paperbacks from them. If you prefer electronic versions, you can try to obtain these from an online retailer. This book does not introduce anything other than what Gann wrote except for my attempt to show you how to equate 1 Gann point (as he referred to it in his day) to a number of stock points (depending on the stock you are trading) today. I then tried to emulate Gann’s style of showing an example of the use of his trading methods in chapter 5. It’s purposely written in an old-fashioned way.

Author’s Note:

I AM A TRADER, AND MY desire has always been to trade like W.D. Gann. He was indeed a remarkable man. In my trading experience, I found that his original books work very well in today’s trading environment. That said, a singular problem with applying Gann material lies with the correct use of Gann’s points. Those of you avid Gann readers will know that Gann often said to put a stop-loss order on your purchases or shorts of stock at least 3 points away, and 5 points away from your entry price at maximum. Throughout his material he consistently uses points for referencing the trend, the risk management, etc. However, if you apply these Gann numbers to a random stock, it will be unlikely to work.(Note: I focus only on stocks in this book.)

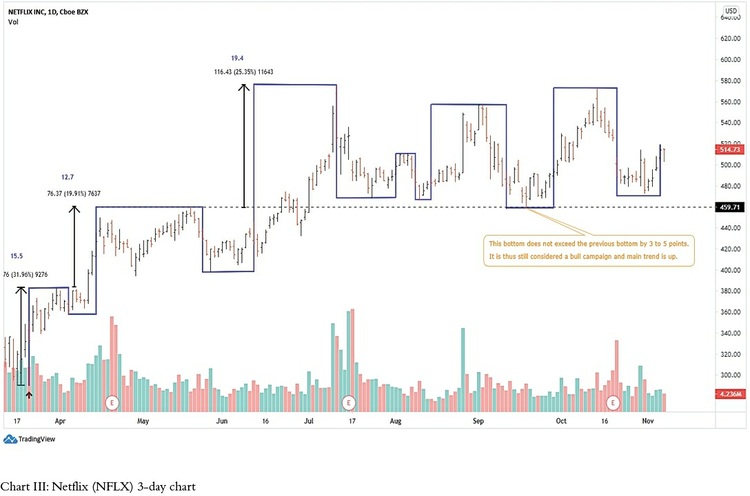

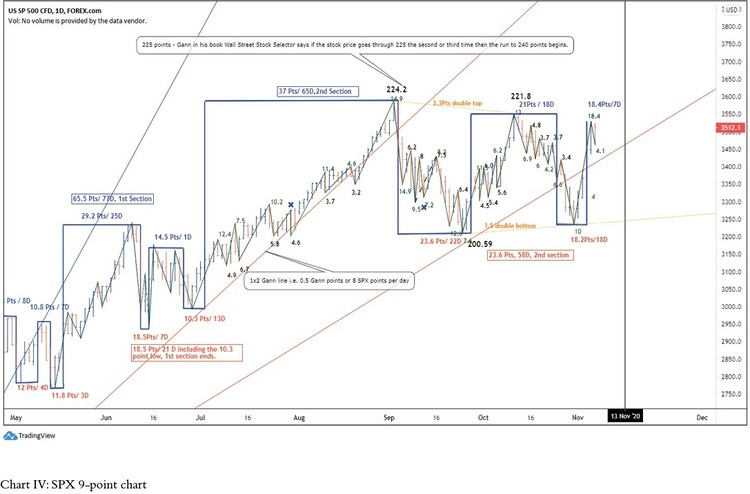

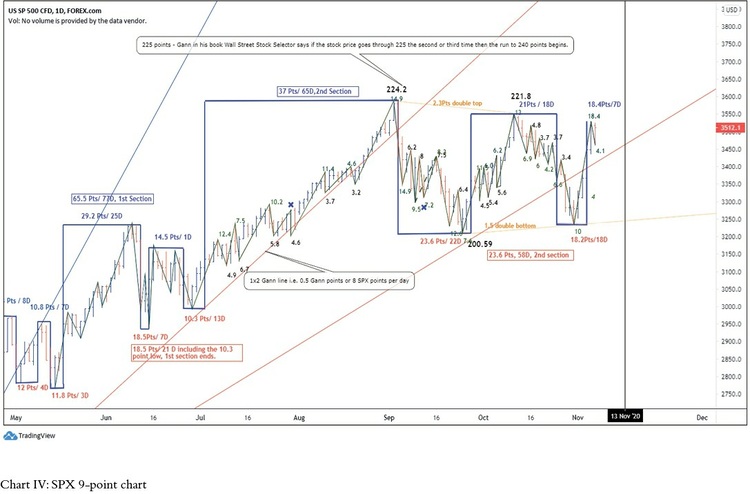

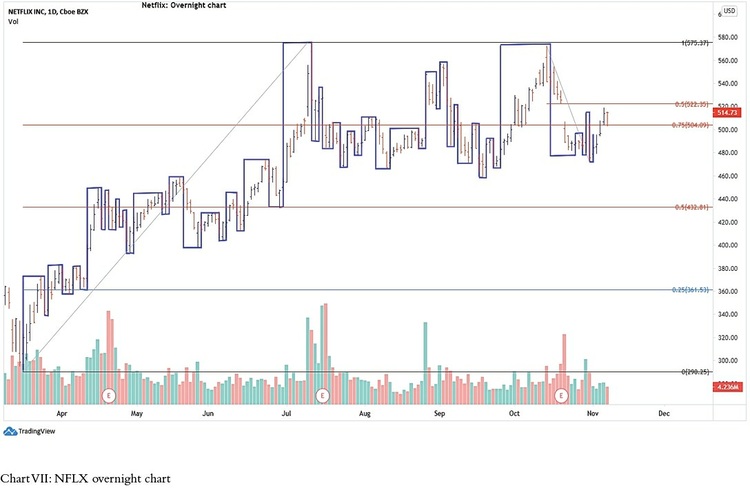

Through my experience, I have found that every stock vibrates to a number, and using the method in this book, you can derive the number of points for that stock relating to 1 Gann point (which refers to Gann’s use of “1 point” in his book). It’s a simple method that requires hard work to track the number vibration, but once you have the vibration and reread Gann’s material, you can begin to understand most of the things he is writing. However, if you don’t understand the 1 Gann point, his books and his works remain closed—every bit of it. The key is to understand the vibration of the stock you are dealing with. For example, I have found by using the methods I present in this book that 6 points of the stock Netflix (NFLX) relates to 1 Gann point. This means that a 3-point stop-loss order would equate to 18 Netflix points.

Gann himself said his method would work for one hundred years; hence, no other material is necessary if you want to study Gann, save for his own books. This book is thus not meant to replace any of the Gann’s original work but to be used only as a supplementary resource.

The actual trading methods that this book will reference belong strictly to W. D. Gann. No improvisations are suggested in this book nor any use of terminology or phrases that are not of Gann’s. Because Gann wrote his books a long time ago, I wrote this book to try to demonstrate how effective his methods still are, if you only get the correct or close-to-approximate vibration of stocks traded in the current day.

In addition, I do not use any fancy software; I only use the popular Trading View charting package to chart my stocks, and in chapter 4 I will show you how I use a set of Gann charts to review the stock price action every day. Gann said to spend at least one to two hours daily to update these charts, and if you do this, you will become confident in your trading. The charts are based on Gann’s methods as stated in his books 45 Years of Wall Street, Wall Street Stock Selector, and New Trend Stock Detector.

As noted in the recommended reading section at the back of the book, I suggest you read the original Gann material—only books written by Gann himself—then read this little book to help you practically apply the rules. Please note that Gann’s books—especially 45 Years in Wall Street—work particularly well for traders doing swing or long-pull trading. I do not do intra-day trading, and I did not see this type of trading specifically recommended in his book.

There are no “secret formulas” or “secret astro cycles” in this book. In addition, the information in this book is original, and I’ve only provided what made me money. It’s a “no filler” book in that sense, straight to the point.

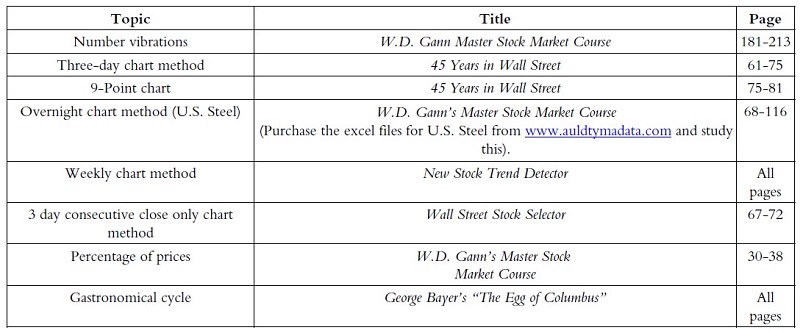

It will be of great help to you to thoroughly familiarize yourself with W. D. Gann’s work in 45 Years of Wall Street. I strongly suggest reading it at least once through, as the techniques I share later for drawing charts come mainly from that book. In addition, please familiarize yourself with Gann’s original books and pages in the following table. If you are using an electronic version, it would be helpful when reading the book to have the chart pack printed in color separately to refer to.

| Author | Craig Morena |

| Pages | 63 |

| Published Date | 2020 |

Some Pictures From the Book

Table of Contents:

- Myths about Gann

- What Is 1 Gann Point?

- Determining the Vibration of Stocks

- How to Set Up Your Gann Charts

- Practical Application – Swing Trading

Unlocking W. D. Gann's Methods: How Gann's Methods Are Applicable to Today's Trading By Craig Morena