Articles

Gann Simplified By Clif Droke

Introduction:

What is it that makes the writings of W.D. Gann so fascinating, yet still controversial to so many? Are there, contained within his writings, specific ideas that unlock the Holy Grail of the stock market and change the way you look at price and volume charts? Can he really help you become a better investor or trader?

Many deeply believe so. In fact, Gann’s writings and concepts are embraced by scores of serious investors and professional traders, to this day. And some of those investors have found, as I have, that his writings have significantly influenced their trading in a very positive way. I can emphatically state that more than any other person, the writings of W.D. Gann have completely changed my ap proach to the stock market. Using his ideas, I was able to increase, by tenfold, a small portfolio of several thousand dollars, over a period of sixteen months.

It was in Gann’s book, Truth of the Stock Tape, that I came across the idea that changed the way I personally looked at price and volume charts, by comparing a stock’s cumulative trading volume to its floating supply of shares. The impact of this idea was like the cliché of “getting hit with a ton of bricks” and here is why: I had observed several dozen high-flying stocks as they came crashing down to earth. It was Gann’s teachings that made me realize that if there was a rectangular distance on a chart in which the cumulative volume equaled the floating supply of shares, then that rectangle represented a proxy for a change in ownership in that company. I then reasoned that a change in ownership most likely would occurr right at the top and that the rectangle could always be seen as the place of final distribution. The implication of these ideas led me to realize that there would also be a rectangular area at long-term bottoms, which could be seen as the place of initial accumulation.

At that time I did not own a computer and charted stocks entirely by hand. With Gann’s ideas resonating in my head, I began the laborious task of tracking the float turnover for a large number of stocks. Adding volume numbers cumulatively and comparing them to a stock’s float was quite difficult and could take hours, even with a handheld calculator. But the end result of this intense study convinced me that my thoughts on the subject were exactly right. I then purchased a computer and hired a systems analyst to write the cumulative-volume float indicator that is documented in my book, The Precision Profit Float Indicator. In short, W.D. Gann had an enormous impact on my approach to the stock market, and it was his direct influence which led me to conclude that the number of shares available for trading was as important as price and volume, and that viewing stocks in this way could reveal accumulation bottoms and distribution tops.

When I first read Clif Droke’s manuscript for this book, I had not read any of Gann’s material in quite some time. I found the experience of revisiting Gann’s work more than enjoyable. There is something about Gann’s material that is akin to reading an ancient manuscript that talks of turning ordinary stones into gold. It is as though one has discovered the actual writings of Merlin.

I truly believe that many of Gann’s ideas are time-less and stand as a testament to a man who spent his life studying the markets, successfully trading them, and sharing his ideas with others. His teachings have stood the test of time and are regarded as one of the foundations of financial research. After reading his work, one gets the impression that Gann had seen it all and understood the importance of sharing his discoveries. Yet, there is also the feeling that his most important discoveries were not fully revealed—and may still be shrouded in some secret code, which has yet to be uncovered. Perhaps new students of Gann techniques will finally be able to unlock the code—and reveal even more of Gann’s impressive body of work.

Those new to Gann’s methods should find Gann Simplified a fascinating introduction. Clif Droke has done an excellent job of delivering the “essence” of W.D. Gann’s writings. He not only gives the reader the best of Gann’s ideas in Gann’s own words, but also elaborates on Gann’s teachings in a clear and easy-to-follow style.

Likewise, even those who have read Gann in the past will find this new book stimulating. Readers will learn that much of the wisdom from today’s top “gurus” originally came from Gann. Gann Simplified also presents essential writings on Gann angles, the Law of Vibration, swing charts, reading the tape, the “24 never failing rules,” the dangers of over-trading, how much to risk on any one trade, using stop loss orders, the importance of weekly, monthly and quarterly charts, and much more. If in reading any book on the stock market I can uncover one nugget of information that will either make me money or save me from losing it, then I feel that my money was well spent. This book certainly meets that criteria and I highly recommend it.

| Author | Clif Droke |

| Pages | 162 |

| Published Date | 2001 |

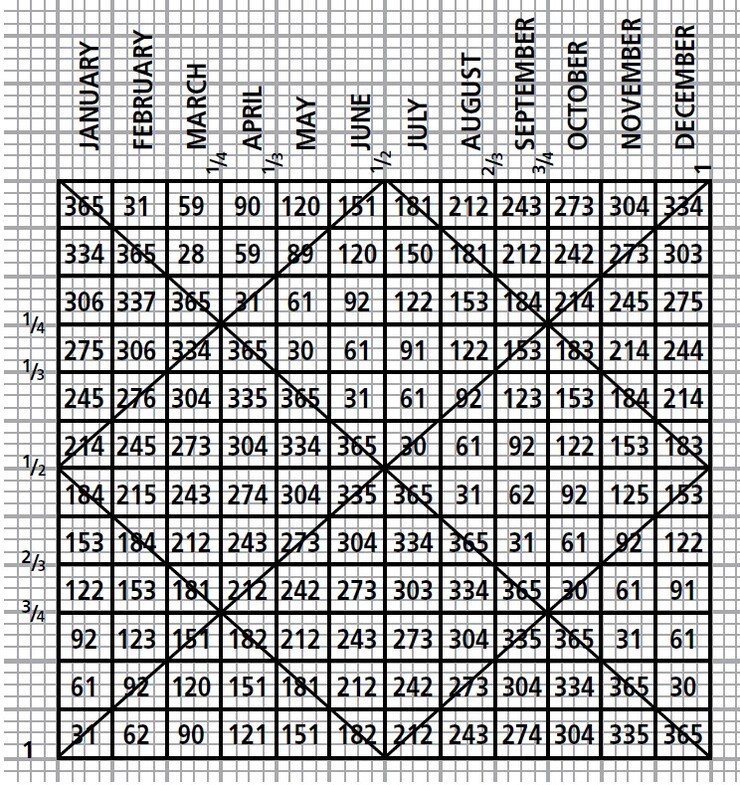

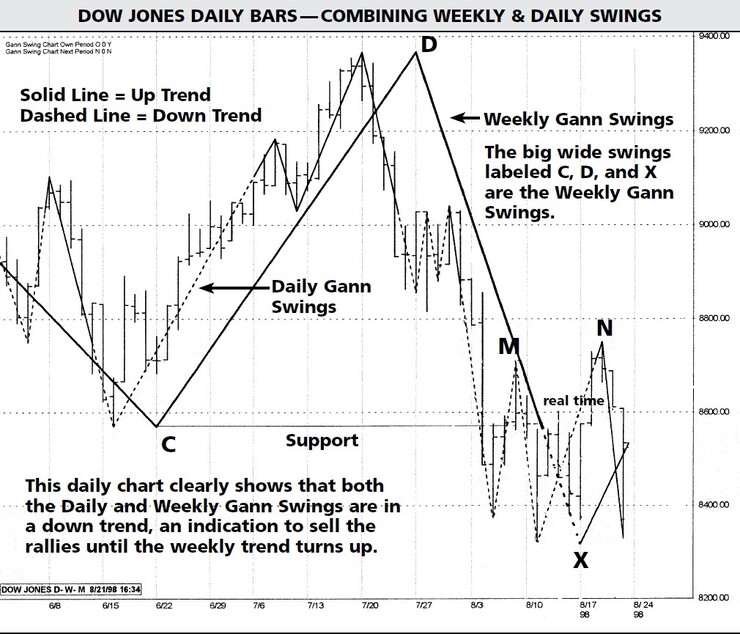

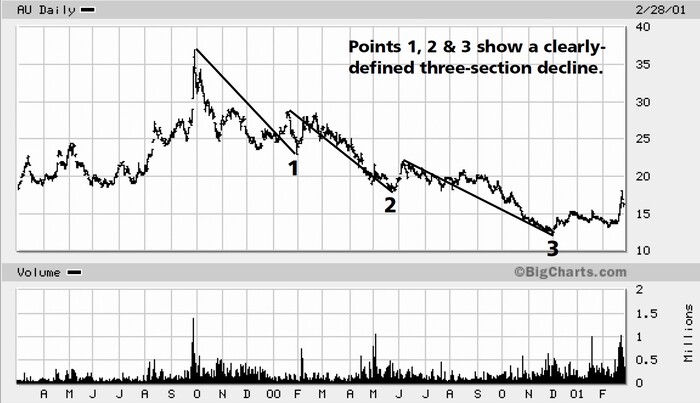

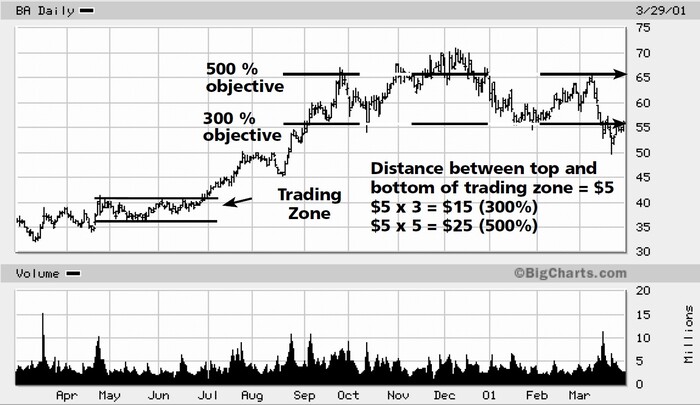

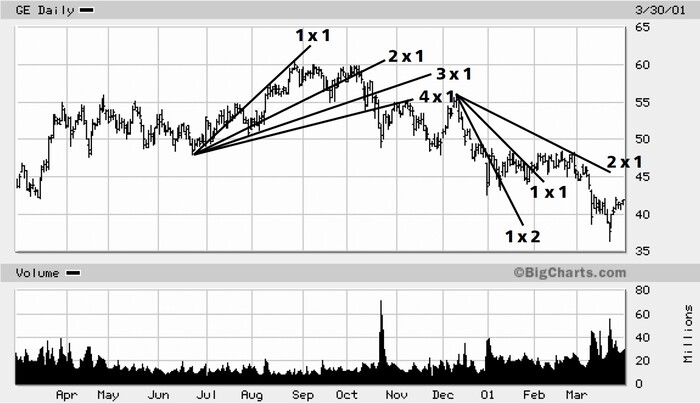

Some Pictures From the Book

Table of Contents:

- W.D. Gann: The Man and His Incredible Trading Legacy

- The Foundations of Gann Theory

- The Truth of the Stock Tape

- Gann’s Chart-Reading Technique

- Identifying Accumulation and Distribution

- The Law of Vibration

- Gann Analysis & Today’s Markets

- The W.D. Gann Method of Commodity Trading

- Rules for Determining a Change in Trend

- Gann Angles

- Gann’s Twenty-Four “Never-Failing” Rules

- Conclusion