Articles

Pattern, Price and Time: Using Gann Theory in Technical Analysis

Pattern, Price & Time offers a breakthrough look at Gann tools and their use in real-world trading systems, filling a longstanding void in Gann Theory literature. This is a must read for anyone looking to thoroughly understand—and successfully implement—one of the most important and powerful forecasting methods in existence.

Pattern, Price, and Time:

Despite the proliferation of trading analysis programs claiming to have “new” indicators and “new” ways to analyze the markets, I’ve come to the conclusion that there really is not anything new under the sun and that all of these discoveries can be placed into the categories of pattern, price, and time.

Ever since the early days of trading up until today, traders have been trying to create ways to manipulate data in an effort to find an edge over everyone else. Today’s sophisticated programs have the ability to smooth data and create sophisticated formulas to make the market’s basic data appear to show anything the programs want to find. Some programs create moving averages, while others try to break down the markets into oscillators that move between 0 and 100. All of these new ways to look at data may be fine for some, provided that they understand how these numbers are created, and the programs create rules on how to use them, but I find working with the original Open, High, Low, and Close data to be most beneficial. In addition, while I acknowledge that using computer-generated oscillators or indicators may speed up the process of analyzing a market, I have found that all of these smoothing tools will eventually collapse to or agree with my simple analysis of the markets using the Open, High, Low, and Close.

This book, although it is concerned with the technical analysis approaches to trading Forex, futures, and equities, should not be considered the definitive answer to making tremendous amounts of money in trading. Instead it should be used as a guideline to give the trader an edge as to what is actually taking place in the marketplace. My application of pattern, price, and time analysis allows me to see and understand what is happening in the markets. It does not hide anything in complicated formulas or computer number crunching. Although this is a personal preference, I feel that the analyst who understands how pattern, price, and time work independently and in unison with each other creates an edge to trading the markets that computerized analysis cannot.

Throughout the book the reader will see the phrase “study and experiment.” This is because the reader is encouraged to learn as much as he can about the movements of the markets, the characteristics of these movements, and how to make informed trading decisions once this knowledge is applied.

The basic premise behind pattern, price, or time analysis is that these three factors have not changed in the 100 or more years since Charles Dow unleashed his Dow Theory to the world. In fact, if you want to go back even further, take a look at Candlestick analysis which is said to have its roots back to the 1700s. This very popular analysis tool is a study of pattern with basic Open, High, Low, and Close the major elements. Despite the proliferation of today’s “new” trading analysis tools and trading systems as a result of the personal computer and trading software, trading tools used today can nevertheless still be categorized as pattern, price, or time.

Today’s pattern studies include stochastic indicators, relative strength indicators, overbought/oversold indicators, moving average crossovers, and Candlesticks. Price is categorized as moving averages, daily pivots, and retracements. Finally, time is used today in the form of seasonality, cycles, and time of day studies. Hang around a trading room long enough, and you will often hear, “I had the right price, but was a little early” or “I’ve got a cycle low due at 11:00, I just don’t know where the market will stop.” These are the types of problems that can be created by using only price, or only time, or only a pattern. In this book I want to show the trader that there is a way to bring the factors of pattern, price, and time together in an effort to improve trading results.

When studying the history of technical analysis I came across several valid methodologies to analyze and trade the markets, but I found that these methods were weighted toward only one of the three main components of pattern, price, and time. This created problems for me because although at times one of these factors had control of the market, I found I did not have control of the trade. This frustration caused me to study the disciplines of Elliott and Dow, but I found personal issues with each. One relied too much on the forecast and prevented me from changing my mind while in a trade. My ego became too connected to the forecast, and I often failed to make necessary adjustments to the trade. The other analysis technique took too long to develop. I also tried to work with point and figure charts, and although I understood how to use the formations, I still felt time was necessary to help me become a better trader. When Candlestick analysis became readily available on the computer, I tried to use it, but found some of the patterns occurred too frequently and at random places on the chart, so I sensed that price and time would be necessary to improve this sort of analysis.

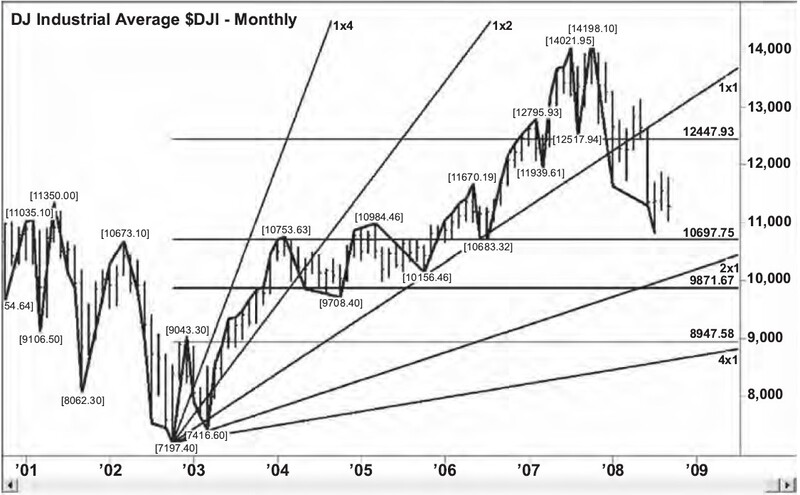

All of this study and experimentation of these other analysis disciplines led me back to the pattern, price, and time analysis of W. D. Gann. I chose Gann Theory as my primary source of analysis because throughout his works he wrote about the balance of price and time. This became very important to me because my work needed balance. I knew from my analysis and trading that I could not just rely on pattern, or price, or time independently. I knew that although I could use his techniques independently, I could improve my analysis and trading by finding a balance between his two or three key elements of pattern, price, and time (Figure 1).

Figure 1

In summary, the purpose of this book is to inform the trader of the analysis tools that are available just using the Open, High, Low, and Close. The other purpose is to teach the trader to categorize his trading tools into pattern, price, and time techniques and to apply combinations of the tlu·ee to improve his analysis and trading. Finally, in an effort to jump-start the reader’s study and experimentation of pattern, price, and time, I have chosen to highlight the analysis and trading techniques of W. D. Gann because he was one of the first to speak of the balance of price and time.

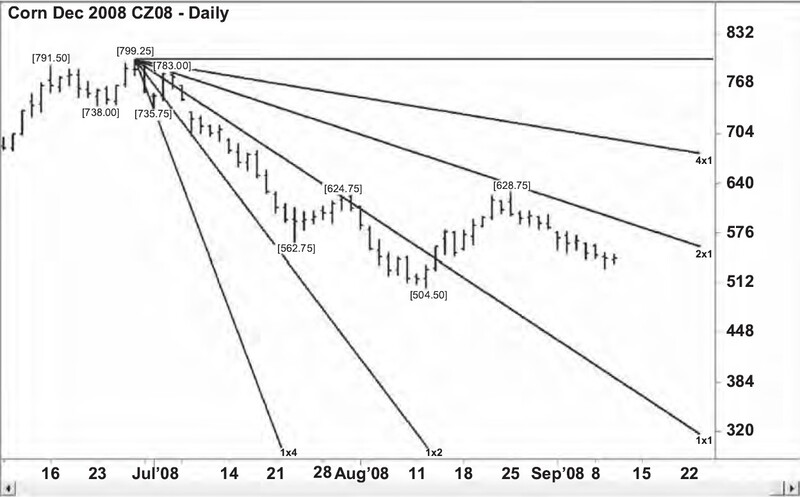

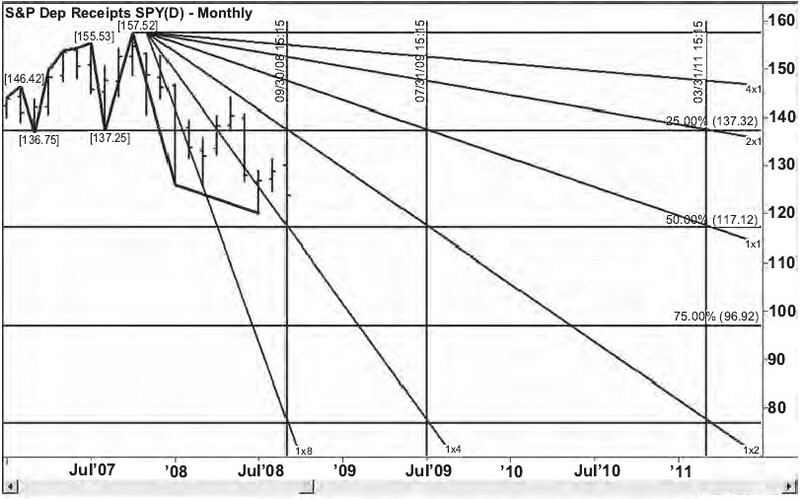

Some Pictures From the Book

| Author | James A. Hyerczyk |

| Pages | 284 |

| Published Date | 2009 |

Table of Contents:

- Why Pattern, Price, and Time?

- Who Was W. D. Gann?

- Gann Theory In a Nutshell

- Chart Basics

- Pattern: Trend Indicator Charts

- Pattern: Swing Chart Trading

- Pattern: Other Chart Formations

- Price: Horizontal Support and Resistance

- Price: Gann Angles

- Combining Pattern and Price

- Time

- Combining Pattern, Price, and Time

Pattern, Price and Time: Using Gann Theory in Technical Analysis By James A. Hyerczyk