Articles

Gann And Gann Analysis

There’s a lot of trading lore behind the life and trading career of W.D. Gann. How much of it is true and how much has been exaggerated? Here’s a deeper look. What exactly is behind the legend of W.D. Gann? We often think of him being held up as a legendary trader and as having developed useful trading techniques. But yet, in the almost two decades I have spent as an institutional trader, I can tell you that I never heard a professional trader or money manager ever once mention Gann analysis.

I did come across the methodology while studying for the Chartered Market Technician (CMT) designation, but that was a long time ago and I had since forgotten many things about it. So I decided to embark on an in-depth study of Gann, and I was surprised by some of my findings and conclusions. I will share some of what I learned here.

WHO WAS GANN?

Like many things surrounding Gann, even his life is mysterious. I was only able to find a few facts and they all came with questionable references. In any case, it seems that Gann was born in Texas on a cotton ranch in 1878. He eventually ended up in New York City and opened a brokerage office in 1908. According to one source I read, he was apparently quite the playboy and a big partier and gambler. At that point, it seems that he developed a reputation for himself as a phenomenal trader. It is important to note that many of the stories that I read about Gann’s alleged success aren’t footnoted, and the few that are all refer to the same dubious publication. Furthermore, experienced traders know that success ultimately comes from risk management and proper psychology, a fact that Gann seems to have understood although his legions of followers do not always seem to.

In my opinion, there is an element of weirdness to the claims that some of Gann’s proponents made. For example, one popular book on Gann reads like a bad ad in a tabloid. The author claims that over a period of 25 market days, Gann had a success rate of 92.31% and turned $450 into $31,000. If you believe that, you’re a sucker. Not surprisingly, there is no footnote for that claim.

More “proof” of Gann’s alleged greatness comes from a supposed colleague of Gann who saw him turn $130 into $12,000 in one month. Of course, that “colleague” is nameless. After some research, I located the article this story came from. It wasn’t from a newspaper but rather a magazine called The Ticker And Investment Digest and I don’t put too much credence into it. After all, about twice a week I get a tabloid multipage advertisement in the mail that claims that the writers’ last prediction yielded something astronomical like a 4,000% return in a month or something similar and that if I don’t subscribe immediately I will miss the next “once-in-a-lifetime monthly idea.” My guess is that the article concerning Gann’s returns was an advertisement like this one and not real journalism.

His followers also claim that he allegedly predicted the stealth bomber 60 years before it happened, predicted World War II, and predicted the exact date of the Kaisers’ abdication. It’s hard for me to believe that we should take all this seriously. But to be fair, in the 1930s, many people predicted stealth technology because radar had just been invented and the feeling was that if man can invent it, then he can certainly figure out a way to beat it; also, many wise people thought that World War II was inevitable when Hitler came to power.

But in my professional opinion, these other claims of Nostradamus-like abilities are ludicrous and there seems to be no substantiation of them. So there you have it. Gann’s life and trading career is the subject of much mystery and I’m sure we’ll never know many of the details surrounding it. And for those who push or profit from his work, that is no doubt an advantage.

MODERN GANN ANALYSIS APPLIED

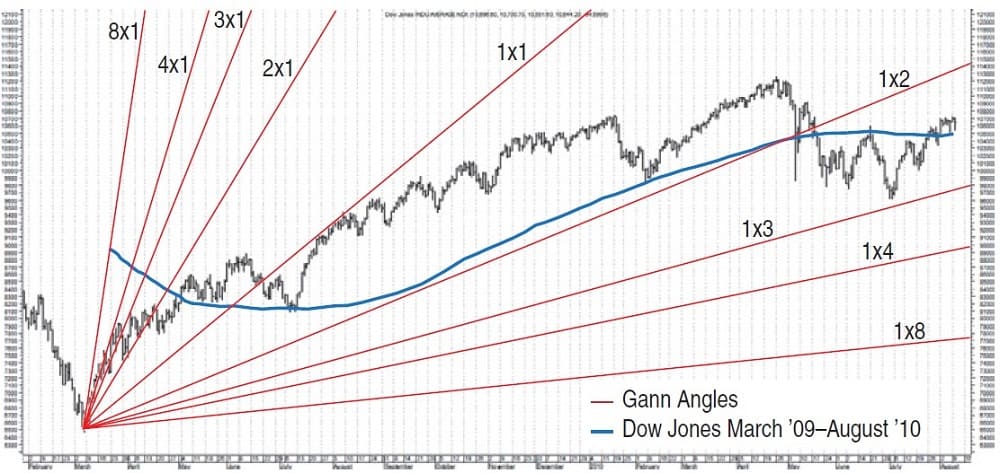

Gann practitioners claim Gann thought that specific geometric patterns and angles had unique characteristics that could be used to predict price action. Gann angles are specified by two numbers and separated by an “x.” For instance, a 1×4 line rises one point for each four time periods. Gann believed the ideal balance between time and price exists when prices rise or fall at a 45-degree angle relative to the time axis. This would be the 1×1 angle. There are nine angles, with the 1×1 being the most important:

1×8, 1×4, 1×3, 1×2, 1×1, 2×1, 3×1, 4×1, 8×1

Each of the angles is supposed to provide support and/or resistance if applied properly on a chart (Figure 1). Gann’s techniques assumed that equal time and price intervals be used on the chart so that a rise/run of 1×1 will always equal a 45-degree angle. The ideal is one price unit for one measure of time. Obviously, that opens the door to a vast degree of interpretation. For example, just what exactly is a price unit? Is it a point or a percentage?

FIGURE 1: GANN ANGLES. Gann believed that the ideal balance between time and price exists when prices rise or fall at a 45-degree angle relative to the time axis. This would be the “1×1” angle. There are nine angles, with the 1×1 being the most important. Each of the angles is supposed to provide support and/or resistance if applied properly on a chart. But there is much room for interpretation in the description.

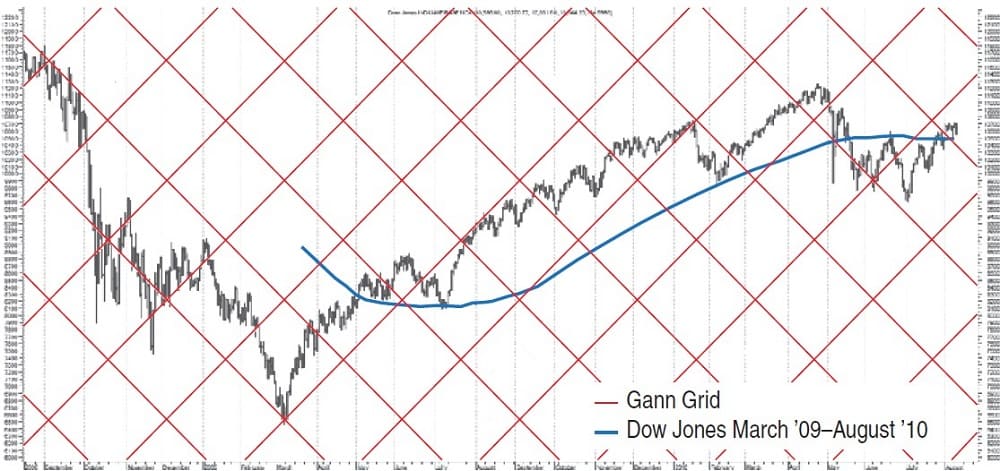

Of course, it isn’t practical to use a unit of 1 on a high-price issue like the Dow Jones Industrial Average. This is one of the fundamental flaws with this type of analysis. Gann purists apparently insist on proper chart scale (Figure 2). This is where it gets weird. According to the believers and followers of Gann theory, it is also supposedly based on what Gann called “the law of vibration,” financial astrology, important numbers, geometric patterns, and a whole slew of other esoteric things that would take a whole book unto itself to explain. Soon things dive into the realm of parapsychology and astrology. Maybe this is why this particular brand of analysis appeals to people, much in the way that legends of ancient aliens building the pyramids or of Bigfoot romping around the forests of Canada do, but I can attest that in the real world, I have never seen a successful trader or portfolio manager use Gann’s work.

FIGURE 2: CHART SCALE. It isn’t practical to use a price unit of 1 on a high-price issue like the DJIA. This is one of the fundamental flaws with this type of analysis.

CONTROVERSY SURROUNDING GANN ANALYSIS

Gann’s followers and advocates treat him with a reverence. But there are many obvious holes in the Gann success theories. First of all, Gann analysis as advocated by modern practitioners can be easily disproved by something as simple as switching from a standard to a logarithmic chart or changing the scale.

Second, if you carefully read some of the “analysis” that has been put out by Gann enthusiasts, it will soon be apparent that much of it is contradictory.

Third, what about common sense? We all know that if it seems too good to be true then it probably is. If Gann had the success that his proponents allege, then he would have amassed a fortune.

Fourth, if his forecasting methods were so accurate, then why did he spend so much time in his books discussing risk management and trading rules?

🧠 Deep Dive into Gann’s Methodology

WAS GANN PERSONALLY SUCCESSFUL?

The main focus of Gann’s career was writing and teaching courses. In fact, in his original books, there are many advertisements for his work. One states that Gann is “too busy to take time to answer inquiries in regard to the rules except from people who send $1.00 to pay for their inquiry.” Presently, I am not aware of any successful money managers who charge for snippets of advice but I do know of many trading courses that do.

Don’t get me wrong…I am not here to bash Gann as a person and I did not come across any evidence that he ever did anything wrong. He seems to have run a successful business and I admire him for that. I am merely trying to expose and explain some of the mystery that surrounds modern-day Gann analysis.

MY FINDINGS

When I read Gann’s works I was surprised to find that he didn’t talk about all the esoteric stuff that I heard from others. Instead, he presents many trading rules and gives trading advice that is driven by principles that are still valid today. Instead of relying on a lot of dubious analysis, I went directly to the source. For example, I read the New Stock Trend Detector, which was written by Gann and published in 1936. I was happily surprised to find out that it isn’t nearly as esoteric or as mysterious as modern Gann enthusiasts make it out to be. On the charts that are in the book, which were apparently made by Gann himself, there are no Gann angles or Gann fans. Gann offers many trading rules and insights and there are some predictions that are not correct. Gann followers seem to forget to mention these.

In the first chapter, Gann talks about how much he opposes the New Deal (remember this was written in 1936 so it was a current topic of discussion at that time). It’s amazing how much it sounds like the political debate that is occurring today.In the second chapter, he talks about the “foundation for successful trading,” which includes:

- independent thought

- a definite plan

- knowledge

- patience

- nerve and good health

- adequate capital.

There’s nothing mysterious here. A good question for a Gann theorist would be, if his predictions are so accurate, why would you need these rules? In the next three chapters, Gann gives a detailed verbal explanation and review of the market’s recent history. If you read it closely, he is merely trying to explain how things such as double tops and triple bottoms form. For example, when he writes about “selling at recent top,” he is explaining how a traditional double top pattern may form. Chapter seven is “A practical trading method,” which covers:

- Amount of capital required

- Utilization of stop-loss orders

- How to detect buying and selling points. For example, “Sell against double and triple tops”

- How to pyramid

All in all, most of this book made perfect sense to me and I didn’t find anything that was too mystical or mysterious.

Next I read 45 Years In Wall Street, which was originally published in 1949. Again, I was surprised to find nothing mysterious or esoteric in it. The book consists of commonsense trading rules, detailed descriptions of how chart patterns are formed, and some predictions for the future. The first few chapters include “rules for trading stocks” and “twenty-four never-failing rules,” many of which make perfect sense. Then there are some lengthy detailed discussions concerning how chart patterns form. It is apparent that like many technical analysts, Gann is a believer in cycles and retracements. Then he talks about some great market operators of the past, claims he lent money to Jesse Livermore, talks about overtrading, and the use of stop-loss orders. Then he spends some time discussing his predictions for the future, which seem to include war with Russia and an economic meltdown in the early 1950s.

Next I read How To Make Profits Trading In Commodities, which was published in 1951. It opens with a simple summary of the advantages of trading commodities instead of stocks, and then Gann talks about various trading rules and principles that are similar to the ones in his other books. He then gives a list of qualifications that are required for success in trading. These include:

- stop-loss orders

- independence

- definite plan

- knowledge

- patience

- nerve

- good health.

After this, Gann goes through a whole bunch of topics relevant to commodity trading and spends a short time giving his advice and commentary on each topic:

- How to read the grains or cotton tape

- How the tape fools you

- False hope … eliminate fear and hope

- Markets discount future events

- Human element is the greatest weakness

- Time to stay out of the markets

- The best way to trade

- What to do when commodities are going against you

- What to do when you have a series of losses

- How to answer margin calls

- What causes booms and wars

- Human nature never changes.

Next, Gann goes into a lengthy description of what he calls form reading. I suppose this discussion may seem somewhat mysterious if you don’t have a trading background, but if you do, it makes sense. For example, he writes things like “sell at old tops or old bottoms” and “go with the main trend. Never buck it.”

At this point he goes into a bunch of timing rules, but in my opinion these aren’t predictions but rather additional rules to trade by. Yes, maybe they can be viewed as magical, but remember that many trading systems have time stops as well as price stops.

For example, when he states something like, “Regardless of how high wheat is selling, a decline of five cents below the old top would indicate the trend had reversed and at the medium time would not go higher.” Of course, maybe he did mean them as exact predictions but there are so many things like this that I am sure more than a few turned out as predicted.

Next there are literally hundreds of examples that Gann walks you through where he points out how his rules or predictions regarding price movement in conjunction with time have been accurate. Obviously, hindsight is 20/20 and it is possible that Gann cherry-picked these examples. And of course it’s also possible that the data is not correct … it isn’t footnoted and it would take hundreds of hours to verify or disprove it. Maybe it’s just because I spent decades working in New York City, but I just can’t believe everything that I’m told.

Finally, I read Truth Of The Stock Tape, which was Gann’s first book, written in 1923. It is basically a how-to guide for beginners that covers many general trading rules. Once again there is nothing here that is too esoteric or far out. He describes many principles and dynamics that are still relevant to this day. As with his later books I mentioned earlier, Gann spends time discussing different applications of trading rules and how it is important to do things like maintain good physical health and to be aware of your psychology. Out of his four major books, I thought this was his best one and I would recommend it to those who are interested in learning more about trading. I would also recommend it to those who think that Gann was a visionary guru because they will soon realize that their perceptions of him are wrong.

When I conducted research into Gann analysis it became immediately clear that the modern practice and application of it is full of strange and mystical things. Much of it is focused around financial astrology and the supposed powers behind different numbers. But when I read his actual writings, I didn’t come across any of this. Some things may seem a little mysterious when he writes about how chart patterns form because he spends time focusing on cycles and retracement levels, but to those of us with a background in trading, his descriptions make perfect sense. It seems that in many cases, modern promoters of his systems and analysis have little understanding of his actual work.

GANN’S PREDICTIONS

When reading Gann’s works I found some pretty bad predictions, although I must say that I admire how he had the guts to put precise calls into print. Here are just two of the most notable, which, by the way, I didn’t see on any of the websites that promote his work. In 1936 Gann said, “I am confident that the Dow Jones Industrial Average will never sell at 386 again.” At the time, the Dow Jones was trading between 150 and 180. For some reason, Gann proponents always seem to miss that one. The DJIA surpassed 386 in the fall of 1954. 386 was an important number because it was the peak before the crash in 1929.

In 1949 Gann predicted the country would face economic calamity in the 1950s. “The Depression and the panic will come before the New Deal goes out of office in 1953. Nothing can prevent it.” And, “1951 and 1952 indicate very depressing years for business and a bear market for stocks.” Gann was wrong about this as well, and as it turned out, the 1950s could be the most prosperous decade the county has ever had. From the beginning of 1950 through the end of 1953 the DJIA was up about 40%.

GANN’S OUTSPOKEN POLITICAL VIEWS

Gann was an outspoken Republican who was disgusted with Franklin Roosevelt and the New Deal. Any student of history would find it interesting to note the parallels between what was going on in the 1930s and what is happening now. Many of his points are astute and surprisingly relevant 75 years later.

He calls the New Deal the “raw deal” and says the policy is “creating a nation of loafers.” He talks of how the policies that were being followed in Washington will ruin the country. He points out that many of the laws that FDR passed were found to be unconstitutional by the US Supreme Court. Here are some of the things he said:

- “The New Deal thrives on promises, promising everybody something for nothing.”

- “What caused France to lose the war? It was unions and Communism.”

- “The right to union labor leaders is given by politicians who have betrayed the rights of the people who elected them.”

WHY ARE PEOPLE OBSESSED WITH GANN?

Essentially, I think the reason comes down to the work being already done and the mystery that surrounds it. Most people like the idea of studying a chart or two and using some magic so they know which basket to put all of their eggs in. They’d rather do that than study the markets every day … which is the true secret of success. And for whatever reason, people enjoy a good mystery, sometimes to the point of irrationality.

When I was researching Gann, I saw Gann trading classes and programs that were offered for thousands of dollars. I spent about $70 to buy Gann’s four main books, and over the course of a weekend I realized the real Gann is nothing as advertised. But for anyone who has an interest in trading and history, they are good books and there are many great lessons about trading in them. In a way, it is a shame that his actual work has been ignored and misunderstood.

It goes without saying but I’ll say it anyway. If these Gann promoters had the holy grail of trading, they would be trading themselves. They wouldn’t sell the information to others who would all get into the same trades, thereby diminishing their potential profits. Always remember: Whether it’s trading or any other aspect of life, if it sounds too good to be true then it probably is.

MY CONCLUSIONS

- As practiced, I believe modern Gann theory has stretched into the ridiculous and I would recommend that you not waste your time learning or applying it. It is easily disproved and full of contradictions.

- It’s obvious that the legend of Gann has far surpassed the reality of the man. Most modern Gann analysis seems to be adaptations and expansions of his work that are nothing like Gann originally proposed. I think there’s a good chance that if Gann himself saw a modern chart with a “Gann angle” or “fan” on it, he would not even recognize it.

- When I look at Gann’s original charts in his original books I do not see any angles or fans drawn on them, and his actual books do not contain any of the mysticism that his modern-day proponents are so fond of.

- The books that were written by Gann (and not someone purporting to be a proponent of Gann technique) are filled with great trading wisdom and verbal explanations of how some classical patterns like double and triple tops or bottoms are formed.

- Based on the available evidence, I think it is obvious that Gann wasn’t successful as a trader. If he were, he probably would not have had time to write all these books. He made his living selling his trading methods. He also wrote novels.

- Gann was a relentless self-promoter and he advertised in all of his books. He actually ran an ad in some of his original books that states he will answer questions about his work for $1 per inquiry.

- Gann may have made some accurate predictions, but he also made some that were wrong.

- There many analysts who aren’t successful traders and Gann seems to have been one of them. The secret of success in trading comes from emotional discipline, not from astrology and magic numbers. While many people can produce decent analysis regarding the markets, few can trade successfully.

- The legend of Gann is alive and well and probably will be for some time.